San Jose, California: Latent View Analytics Limited (BSE: 543398, NSE: LATENTVIEW), an AI-driven analytics, data engineering, and consulting firm, today announced its financial results for the third quarter ended December 31, 2025.

Rajan Sethuraman, Chief Executive Officer, LatentView, said, “We are pleased to report the 12th consecutive quarter of revenue growth, delivering 7.9% sequential growth and 22% YoY expansion. Q3FY26 continued to be a seasonally strong quarter for us, in line with historical trends, with performance reflecting consistent execution across the organization. During the quarter, we added 6 new client logos, while renewing most of our existing contracts. Our Financial Services practice continued to be a key growth driver, witnessing sequential growth of 20.6% and reinforcing its strategic importance to our overall performance. As we enter FY27, we continue to see strong, sustained momentum in Financial Services, reflecting the deep strategic role LatentView plays in supporting our clients’ short-term priorities and long-term business goals. 2026 marks our 20th anniversary, and our commitment to turn data into impactful business decisions is as strong as ever. Looking forward, we remain focused on scaling AI and Agentic AI frameworks across the organization and strengthening our position as a trusted AI consultant and thought partner of choice for our clients.”

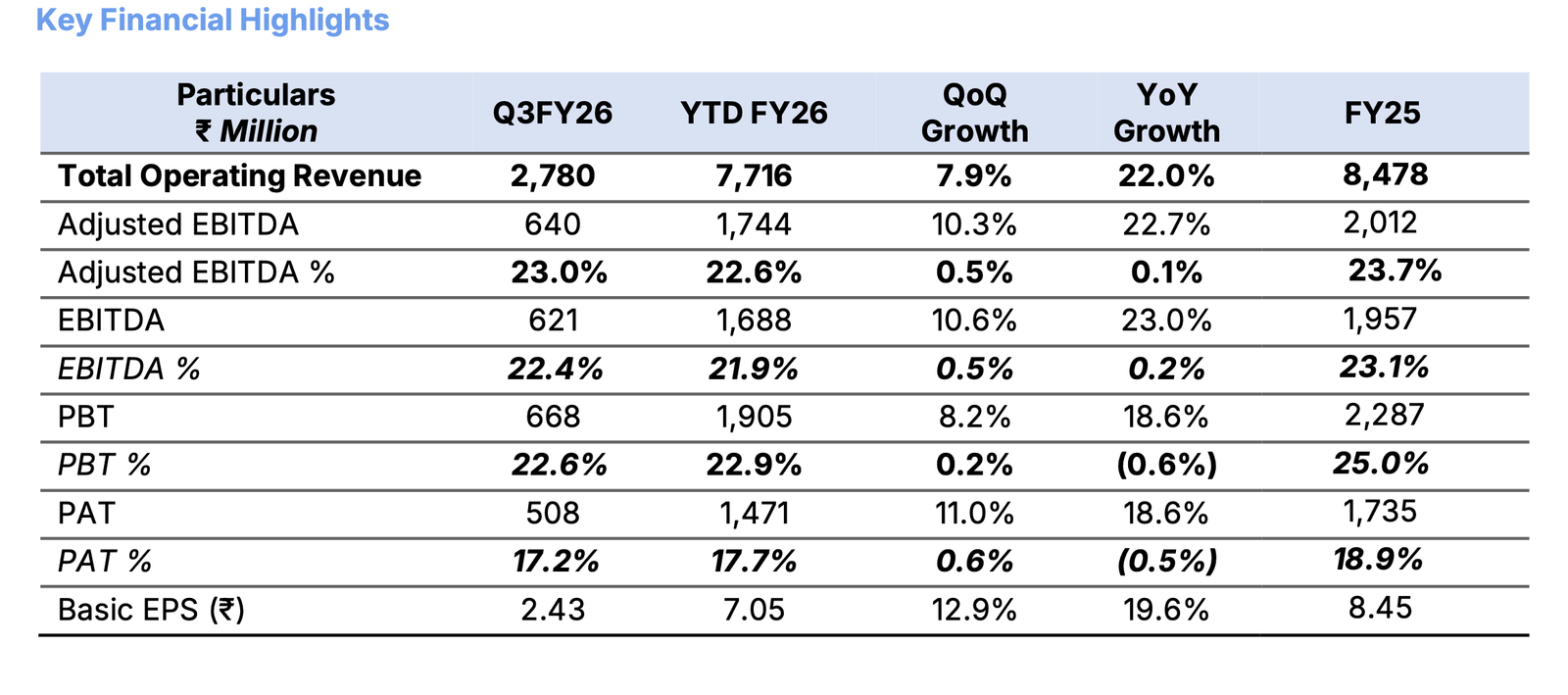

Rajan Venkatesan, Chief Financial Officer, LatentView, said, “In Q3FY26, we reported revenue of ₹2,780 million, witnessing sequential growth of 7.9% in rupee terms and 5.7% in dollar terms, indicating strong momentum in topline performance. The growth was primarily led by the Financial Services and Technology practices, which grew by 20.6% and 6.2%, respectively. We maintained an adjusted EBITDA margin at 23.0%, supported by operational discipline, despite the impact of one‑time costs. Excluding these one‑time items, adjusted EBITDA margin for the quarter would have been 24.6%. Employee costs for the quarter included a one‑time catch‑up expense related to the implementation of the new labour code, with a total impact of ₹46 million at the group level. On a recurring basis, we expect this to result in an incremental impact of approximately 10-15 basis points on margins going forward. We are in the process of restructuring salary components to ensure full compliance with the new labour code and expect this exercise to be completed by March 31, 2026.”