Jaipur: Aavas Financiers Limited has declared unaudited Financial Results for the quarter and nine-month ended 31st Dec 2025.

Performance Highlights:

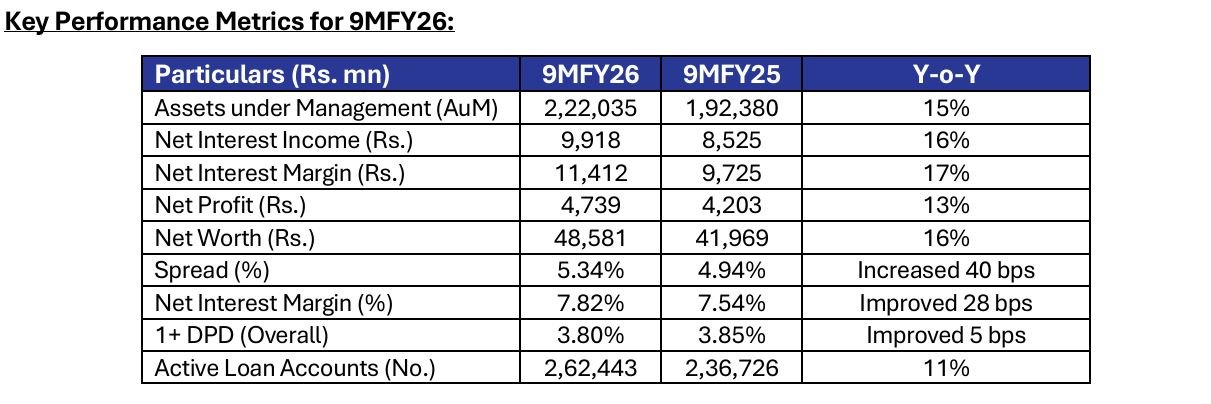

- Assets under Management (AuM) of the company registered a growth of 15% to reach Rs. 222 bn as on 31-Dec-25.

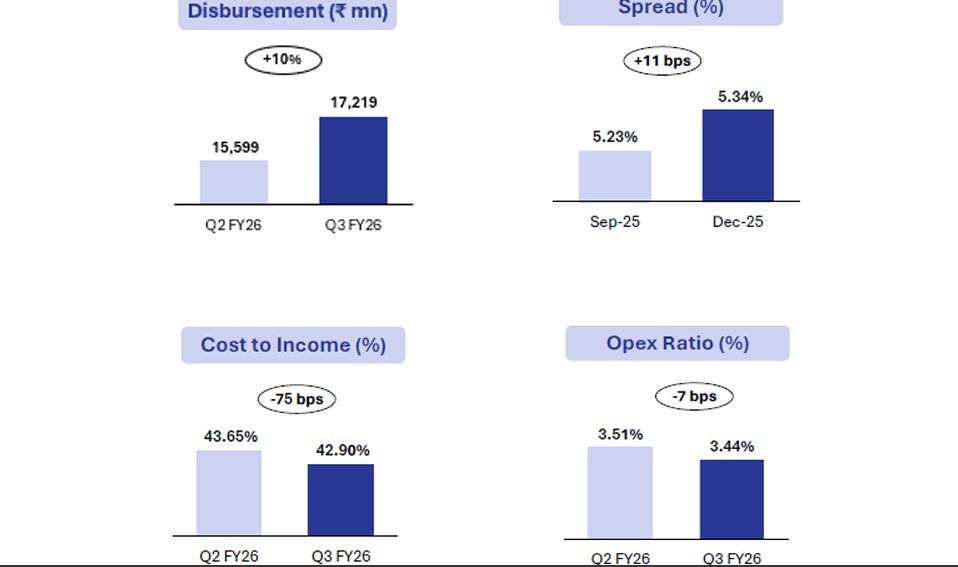

- During Q3 FY26, we disbursed loans worth Rs 17.2 bn, registering a 10% sequential growth, while maintaining our strong focus on quality origination and prudent underwriting.

- Our Net profit for Q3 FY26 grew by 16% YoY to Rs 1.70 bn led by robust 17% YoY growth in NII on account of healthy improvement in spread.

- Our spread continued to expand during the quarter, up by 40 bps YoY to 5.34% driven by our borrowing cost improving by 56 bps YoY to 7.68%.

- Our NIM in absolute terms increased by 18% YoY in Q3FY26, while NIM as a percentage of total assets during Q3FY26 stood at 8.01% up 27 bps YoY.

- The green shoots of our improved operational efficiency have started to reflect in the cost ratios. Our Opex-to-Assets ratio declined 7 bps sequentially to 3.44%. The Opex to AuM ratio also marked a 9-bps improvement sequentially to 3.1%, while the Cost-to-Income ratio declined further 75 bps sequentially to 42.9%.

- Our asset quality remains pristine, with 1+ DPD well below 5%, improving by 19 bps sequentially to 3.80% as of December 2025, while GNPA levels improved by 5 bps sequentially at 1.19%.

- Credit costs remained stable at 16 bps, driven by lower 1+ DPD flow and stability in Stage 2 and recoveries in Stage 3 buckets. We continue to maintain our guidance of keeping credit costs below 25 bps on a sustainable basis.

- Our Net Worth continues to compound steadily, growing at 16% YoY, with the strength of our capital position driven by consistently compounding internal accruals.

- Our ROA improved by 6 bps YoY to 3.43% and ROE improved by 8 bps YoY to 14.29%.

Sachinder Bhinder, Managing Director &Chie f Executive Officer, said: “Dear All, The Atmanirbhar Union Budget, progress on the India–US trade engagement along with recent macro and policy developments have strengthened the outlook for India, supporting liquidity, conducive interest rates environment, and improving conditions for credit growth. Continued focus on capex, affordable housing, and tier‑2 and tier‑3 markets further reinforces a positive structural backdrop for housing finance with HFCs and NBFCs at the core.

In Q3 FY26, we accomplished a key milestone in our growth journey with the balance sheet surpassing Rs. 20,000 crores. Further the Company also completed its largest-ever NCD issuance, raising approximately Rs. 975 crore (USD 108 million) from a leading multilateral financial institution at a competitive cost, underscoring strong external confidence in its disciplined, quality‑led growth strategy.

Operationally, performance has normalized post the new disbursement recognition transition, with 10% QoQ growth in disbursements. AUM rose 15% YoY to Rs. 222 bn, supported by firm property prices and a favorable rate backdrop.

Our technological transformation continues to drive meaningful improvements. As of Dec 2025, the turnaround time from login to sanction has been reduced to 6 days, a significant improvement from the earlier peak of 13 days.

Our strong underwriting standards and tech-enabled collection efforts have enabled us to preserve and further the pristine asset quality of the portfolio despite the backdrop of an overall tight macro environment. As of Dec 2025, the 1+ days past due to metric stands at 3.80% down 19 bps QoQ, while Gross Stage 3 at 1.19% improved 5 bps QoQ.

Government initiatives such as the Interest Subsidy Scheme (ISS) under PMAY 2.0, combined with a supportive interest rate environment, continue to bolster homebuyer sentiment and improve affordability. I’m pleased to report that over 2,800 Aavas customers have benefited from these schemes, receiving subsidies totaling more than Rs 90 million.

Our firm commitment to Governance, Asset Quality, Profitability, and Growth remains paramount.

By harnessing advanced technology and delivering exceptional customer experiences, we are confident in a bright future. Our strategic initiatives are poised to drive sustainable growth and maximize shareholder value.