Kochi: Muthoot Finance Limited (MFIN):

• Opened 150 new branches by the Group in 9M FY26.

• Launched Muthoot Shiksha Jyothi, a digital learning initiative across 75 government schools in North, East and West India.

• Flagship CSR initiative Muthoot Smart Classrooms and Anganwadi Project recognised as ‘Best Project under Education and Literacy’ at the Rotary India National CSR Awards.

• Secured four Gold awards at the E4M ICMA Awards (Season 3) for the flagship campaign Sunheri Soch,

underscoring leadership in purpose-driven content marketing.

• Recognised with a Silver at the ET Shark Awards for a data-led, impact-focused approach, and a Gold at the Pepper Awards for creative storytelling and performance-driven outcomes

Key Subsidiaries – ‘Stable Performance Across Subsidiaries’

Belstar Microfinance

• Opened 39 gold loan branches in 9M FY26 to diversify the loan product portfolio, Total branches as on 9M FY

26 is 1290 vs 1224 branches on 9M FY 25

• Collection Efficiency increased by 1.11% at 99.64% in 9M FY 26 which was 98.53% on 9M FY 25

• Disbursed Rs. 5,589 crores in 9M FY 26 vs. Rs 4,760 crores in 9M FY 25; growth of 17% YoY

• Corporate Agency income started from the Q3 FY26 to the extent of Rs 5 Crore.

• Direct Assignment Transaction done to the extent of Rs 178 Crore.

Muthoot Homefin

• Loan AUM at Rs.3,380 crores in 9M FY26 vs. Rs. 2,720 crores in 9M FY25; growth of ~24% YoY

• Disbursed loans of Rs. 715 crores in 9M FY26

• Interest income increased at ~41% YoY to Rs. 274 crores in 9M FY26 vs. Rs. 194 crores in 9M FY25

• Profit After Tax stood at Rs. 19 crores in 9M FY26

• GNPA at 2.32 % in 9M FY26 and NNPA at 1.42%

Muthoot Money

• Loan AUM at Rs. 8,003 crores in 9M FY26 VS. Rs. 2,982 crores in 9M FY25; growth of ~ 168% YoY

• Equity Share Capital infusion of Rs. 1,000 crores during 9M FY26 increased the total capital base to Rs.2,223 crores

• Total income increased at ~ 222% YoY for 9M FY26 stood at Rs. 862 Crores vs. Rs. 268 crores in 9M FY25

• Profit turnaround: from Rs. 2 crore loss in 9M FY25 to Rs.203 crore profit in 9M FY26

Results

A meeting of the Board of Directors of Muthoot Finance Ltd. was held today to consider and approve the unaudited

standalone and consolidated results for the quarter and 9 months ended December 31, 2025.

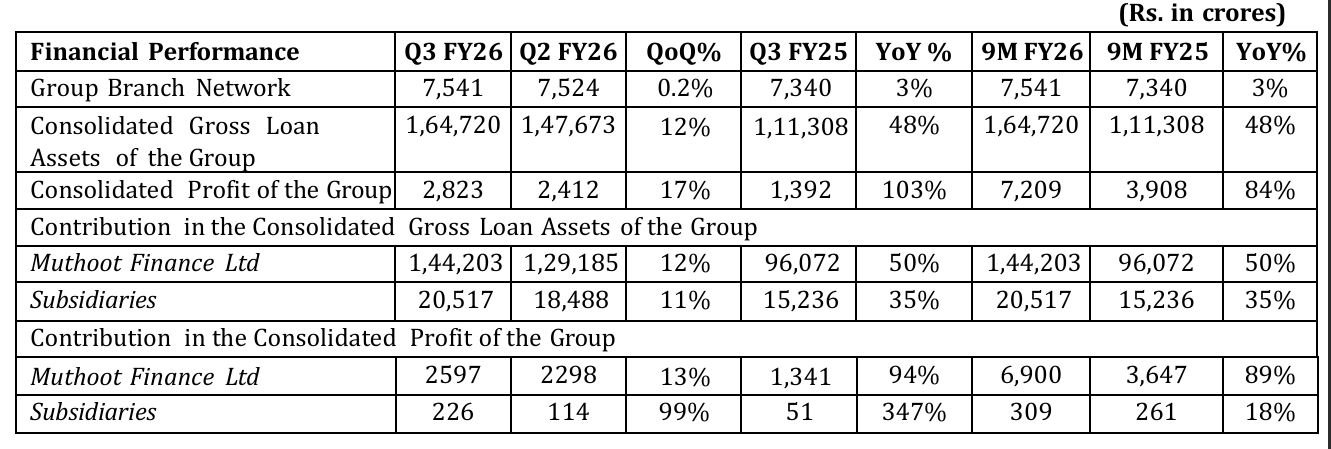

Consolidated Results of Muthoot Finance Ltd Muthoot Finance Ltd Consolidated Loan Assets Under Management grew 48% YoY to Rs. 1,64,720 crores in 9M FY26 as against Rs. 1,11,308 crores in 9M FY25. During the nine months, Consolidated Loan Assets Under Management grew by Rs. 42,539 crores, growth of 35%. Consolidated Profit after tax for 9M FY26 stood at Rs. 7,209 crores as against Rs. 3,908 crores last year, an increase of 84% YoY. During the quarter, Consolidated Loan Assets Under Management grew by Rs. 17,046 crores, growth of 12%.

Standalone Results of Muthoot Finance Ltd and its subsidiaries

Muthoot Finance Ltd (MFIN), India’s largest gold financing company in terms of loan portfolio, registered profit after

tax of Rs. 7,048 crores in 9M FY26 as against Rs. 3,693 crores in 9M FY25, an increase of 91% YoY. The profit after tax

for Q3FY26 stood at Rs. 2,656 crores as against Rs. 1,363 crores in Q3 FY25, an increase of 95% YoY. Loan AUM stood at Rs. 1,47,552 crores in 9M FY26 as compared to Rs. 97,487 crores in 9M FY25, registering a growth of 51% YoY.

During 9M FY26, Loan AUM increased by Rs. 38,905 crores, registering a growth of 36% and Gold Loan AUM increased by Rs. 36,702 crores, registering a growth of 36%. During Q3 FY26, Gold Loan AUM increased by Rs. 14,740 crores, registering a growth of 12%.

Muthoot Homefin (India) Ltd (MHIL), the wholly owned subsidiary, loan AUM stood at Rs. 3,380 crores in 9M FY26 as

against Rs. 2,720 crores in 9M FY25, an increase of 24% YoY. During 9M FY26, Loan assets increased by Rs. 396 crores, an increase of 13%. The loan disbursement for 9M FY26 stood at Rs. 715 crores. Total revenue for 9M FY26 stood at Rs. 339 crores as against Rs. 246 crores in 9M FY25, registering a growth of 38% YoY. Profit after tax stood at Rs. 19 crores in 9M FY26. Stage III Loan Asset stood at 2.32 % as of December 31, 2025.

M/s. Belstar Microfinance Limited (BML) is an RBI registered micro finance NBFC, and a subsidiary company where

Muthoot Finance holds 66.13% stake. Loan AUM for 9M FY26 stood at Rs. 7,911 crores. Total Revenue stood at Rs. 1,312 crores in 9M FY26. Amidst the adverse environment generally in the Micro Finance Sector, it achieved a significant turnaround in Q3 FY26, posting a Profit After Tax of Rs. 51 crores partially offsetting the loss incurred in H1 FY26 of Rs.160 crores to Rs. 109 crores. Stage III Loan Asset stood at 4.93% which has a provision coverage of 96.59%. The higher Stage III % is also consistent with industry peers. Consequent to RBI allowing micro finance companies to have 40% non-microfinance loan portfolio, it has opened 39 gold loan branches in 9M FY26 to diversify the loan product portfolio.

Muthoot Insurance Brokers Pvt. Limited (MIBPL), an IRDA registered Direct Broker in insurance products and a wholly owned subsidiary company generated a total premium collection amounting to Rs. 329 crores in 9M FY26.

Total revenue for 9M FY26 stood at Rs. 102 crores. It achieved a Profit after tax of Rs. 23 crores in 9M FY26. Asia Asset Finance PLC (AAF) is a listed subsidiary based in Sri Lanka where Muthoot Finance holds 72.92% stake. Loan portfolio stood at LKR 4,224 crores in 9M FY26, as against LKR 2,840 crores in 9M FY25, an increase of 49% YoY. Total revenue for 9M FY26 stood at LKR 703 crores as against LKR 494 crores in 9M FY25, an increase of 42% YoY. It achieved a Profit after tax of LKR 68 crores in 9M FY26, as against profit of LKR 50 crores in last year, an increase of 36% YoY.

Muthoot Money Ltd (MML) became a wholly owned subsidiary of Muthoot Finance Ltd in October 2018. MML is an RBI registered Non-Banking Finance Company engaged in extending gold loans. Loan portfolio for 9M FY26 stood at Rs. 8,003 crores, as against Rs. 2,982 crores in 9M FY25, an increase of 168% YoY. During 9M FY26, Loan AUM increased by Rs. 4,101 crores, an increase of 105 %. Total revenue for 9M FY26 increased to Rs. 862 crores as against Rs. 268 crores in 9M FY25, an increase of 222% YoY. It achieved a Profit after tax of Rs. 203 crores in 9M FY26 compared to loss of Rs. 2 crores in 9M FY25.

George Jacob Muthoot, Chairman, The Muthoot Group, said, “We are pleased to announce another quarter of robust performance, marked by significant milestones in our Loan Assets Under Management (AUM). Our Consolidated Loan AUM has reached a new landmark, crossing Rs. 1,64,000 crores, with the Standalone Loan AUM also exceeding Rs. 1,47,000 crores. The subsidiaries contribute a solid 12% to the Consolidated Loan AUM. This performance is underscored by our Consolidated Profit after Tax for 9M FY26, which saw an 84% year-on-year increase to Rs. 7,209 crores. This significant growth occurred amid a supportive domestic macroeconomic environment: the Union Budget 2026’s focus on fiscal consolidation has boosted confidence, while the RBI’s policy rate cuts and liquidity management have fostered a more accommodative credit landscape. Additionally, targeted GST rate reductions are playing a crucial role in supporting consumption, thereby driving incremental credit demand for households and small businesses. In this environment, our core business of secured gold loans has become increasingly relevant, offering customers timely and transparent liquidity. Higher gold prices have naturally enhanced customer borrowing capacity, while our disciplined underwriting continues to ensure strong portfolio resilience. This consistent performance over the quarters has been enabled by the Group’s vast operational network, comprising over 7,500 ready-to-serve branches and a dedicated team of 50,000+ employees.”

Alongside strengthening our core gold loan business, we continue to selectively expand our presence across other lending segments in a calibrated manner. Our Microfinance vertical recorded strong recovery, reporting a profit of Rs. 51 Crores for Q3 FY26. This was driven by better underwriting practices following the implementation of guardrails. We remain committed to advancing financial inclusion by enabling responsible access to credit and creating long-term value for all stakeholders.”

George Alexander Muthoot, Managing Director, Muthoot Finance, said, “We are delighted to report another quarter

of strong, consistent growth, building on our established performance trajectory. Our Standalone Loan AUM achieved a historic YoY growth of Rs. 50,065 crores, primarily fueled by a robust 50% YoY growth in our core gold loan portfolio. Over the nine-month period (9M), standalone gold loans increased by Rs. 36,702 crores, setting a new record of Rs. 1,39,658 crores.

This performance aligns with the accelerated demand for gold loans, especially evident during the festive season.

Consequently, our Standalone Profit after Tax for 9M grew by 91% YoY to Rs. 7,048 crores.

This success reflects the increasing acceptance of gold loans as a convenient, trusted, and secure credit solution for a diverse customer base, including salaried individuals, self-employed professionals, and small business owners. The higher price of gold has further empowered our customers to unlock greater value from their existing assets to confidently meet their personal and business financial needs.

This sustained demand is powerfully supported by Muthoot Finance’s strong operational foundation and unwavering customer-first approach, anchored by our extensive branch network and long-standing relationships built on trust. Our continuous investments in technology—encompassing digital onboarding, faster processing, and enhanced risk monitoring—are dedicated to creating a smoother and more seamless borrowing experience. By combining prudent lending practices with process integrity and technology-led efficiencies, we remain committed to delivering consistent service quality, safeguarding customer interests, strengthening our core gold loan operations, advancing financial inclusion, and creating enduring value for all stakeholders.”