Jaipur: Insolation Energy Limited among India’s top PV module manufacturers, known for quality and pan-India brand presence, announced its unaudited financial results for the third quarter and nine months ended FY26 on Thursday.

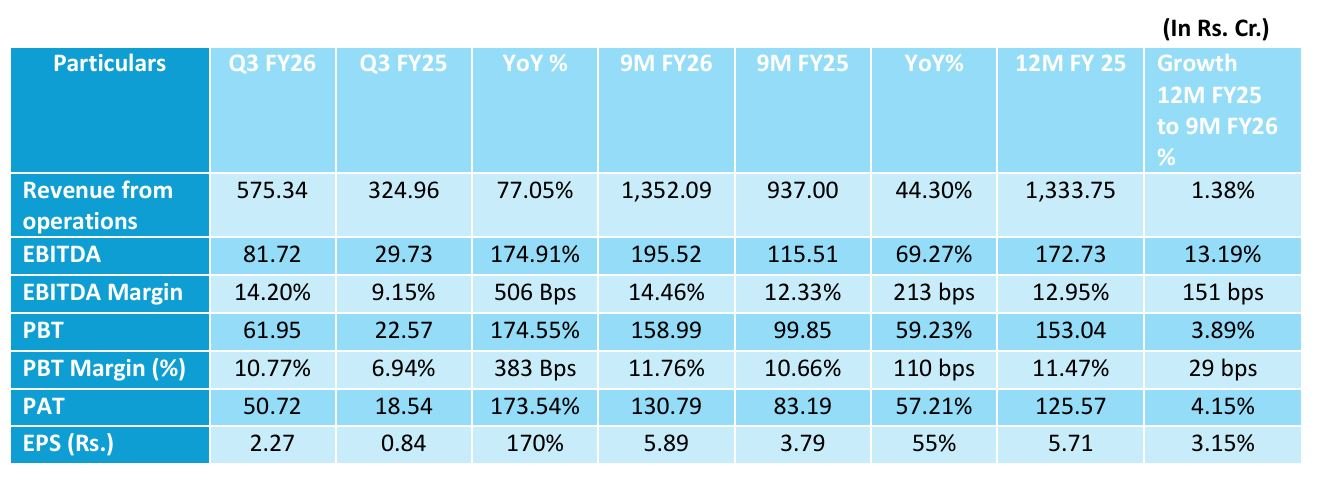

Key Consolidated Financial Summary:

• Revenue (9M FY26): Revenue for 9M FY26 stood at ₹13,520 million, registering a 44% YoY growth, primarily driven by scale-up in capacity, supported by an expanding distribution footprint in utility segment.

• Revenue (Q3 FY26): Q3 FY26 revenue was ₹5,753 million, registering a 77% YoY growth, aided by higher volumes across key markets.

• EBITDA (9M FY26): EBITDA for 9M FY26 stood at ₹1,955 million, up 69% YoY, translating into an EBITDA margin of 14%, reflecting operating leverage and better resilience to price volatility.

• EBITDA (Q3 FY26): Q3 FY26 EBITDA stood at ₹817 million, up 175% YoY, with an EBITDA margin of 14%.

• PAT (9M FY26 & Q3 FY26): PAT for 9M FY26 came in at ₹1,308 million, reflecting a 57% YoY increase, with a PAT margin of 10%. Q3 FY26 PAT stood at ₹507 million, up 174% YoY with a PAT margin of 9%.

Operational Highlights

• Production & dispatches: Q3 FY26 production stood at 356 MW, with dispatches of 364 MW driven by steady execution and C&I demand.

• Capacity ramp-up: The newly commissioned lines at INA3 (4.5 GW facility) were in the ramp up phase during the quarter and are expected to increase production meaningfully in the coming quarters as operations stabilize.

• INA3 is designed to be one of the most automated PV module manufacturing facilities in India, supporting higher throughput, quality, and scalability.

• Installed capacity: As of 31 December, Insolation’s total rated module capacity stood at 5.5 GW, including the latest 1.5 GW line added in December.

Business & Strategic Updates:

• The Greenfield project at Narmadapuram, Madhya Pradesh—comprising 4.5 GW TOPCon G12R Cell manufacturing and an 18,000 MT aluminium frame facility—is progressing as planned, with civil works and PEB activities in full swing.

• This expansion marks a key milestone in Insolation’s backward integration to build a “Made in India” value chain, improving cost competitiveness, strengthening long-term margin sustainability, and enhancing geopolitical resilience.

• KUSUM execution progress: KUSUM projects secured in Rajasthan in the previous quarter— aggregating to more than 200 sites with 400 MW (DC)—have completed all PPAs, providing strong execution visibility and gradually building an IPP portfolio.

Key Consolidated Financial Highlights

Manish Gupta, Chairman, Insolation Energy Limited, said: “Q3 and 9M FY26 reflected steady progress for the Company, driven by higher dispatches, disciplined cost execution, and improving operating leverage. Revenue from operations stood at ₹5,753 Mn in Q3 FY26 and ₹13,521 Mn in 9M FY26, while profitability more than doubled during the quarter. We crossed our last year FY25 financials in this 9M FY26 itself.”

“Despite price volatility in the sector, we remain focused on protecting margins through calibrated product mix, disciplined procurement, and execution efficiency. We continue to prioritize order book quality with strong credit controls and payment security structures.”

“Our balance sheet remains stable. We are managing working capital prudently and phasing capital deployment in a calibrated manner, with a clear focus on returns and long-term competitiveness.

Vikas Jain, Managing Director, Insolation Energy Limited, said: “Our focus remains on execution—stabilizing operations, improving throughput, and ensuring supply reliability. Our manufacturing roadmap is anchored on automation, inline quality controls, and full traceability—building an India-made, local-for-global product.”

“Our backward and forward integration will enable INA to be one of the few companies to have end to-end control of its supply chain. This will allow us to control margins and production and sustain our position in this market by providing quality products”

“We are also migrating to the BSE and NSE Main Board, marking a significant step in our strategy and corporate governance commitment to transparency, governance and shareholder value creation”