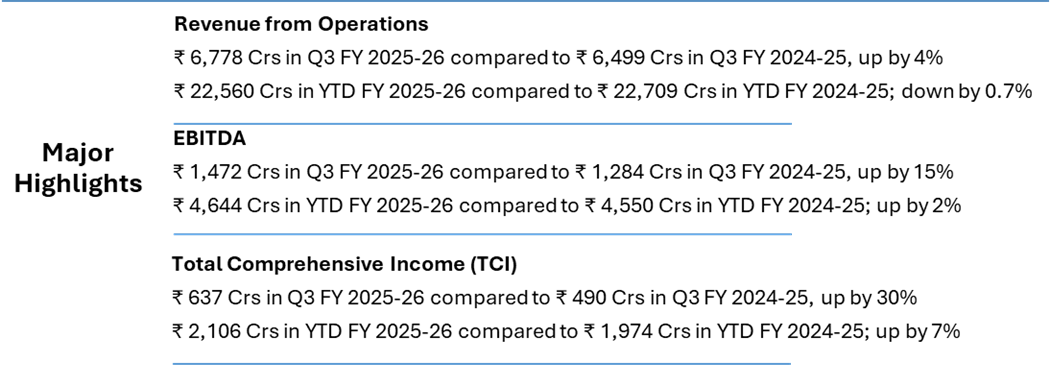

Ahmedabad: Torrent Power Limited today announced financial results for the quarter and nine months ended December 31, 2025.

Higher TCI of ₹ 147 Crs for the quarter on a year-on-year basis is primarily attributable to following:

- Increase in contribution from gas-based power plants;

- Improved operational performance of licensed and franchised distribution businesses;

- Improved operational performance from Renewable Energy segment off set by higher interest and depreciation cost;

- Gain on sale of Non-Current Investments in Q3 2024-25.

The Board of Directors, at its meeting held today, has approved an interim dividend of ₹ 15 per equity share underscoring the Company’s strong operational performance, cash flows, financial discipline, and commitment to delivering consistent value to shareholders.

Key Development During the Quarter:

Long‑Term LNG Supply Agreement with JERA

In a strategic move to strengthen fuel security and support long term growth, the Company has entered into a 10‑year LNG Sale and Purchase Agreement with JERA, Japan, for the supply of up to 0.27 MMTPA of LNG starting from 2027. The Company will use the LNG to efficiently operate its 2,730 MW gas‑based power plants, to meet the country’s rising power demand, peak demand periods’ support, and balancing the renewable. This agreement will also ensure dependable gas availability for Torrent Gas Ltd., to serve households, commercial establishments, industrial consumers, and CNG vehicles.

This long‑term arrangement reinforces the Company’s integrated energy strategy, enhances supply reliability and positions it well to capitalize on India’s growing power and clean energy demand.