Mumbai: Fine Organic Industries Limited has announced its financial results for the Quarter and months ended 30th June 2025.

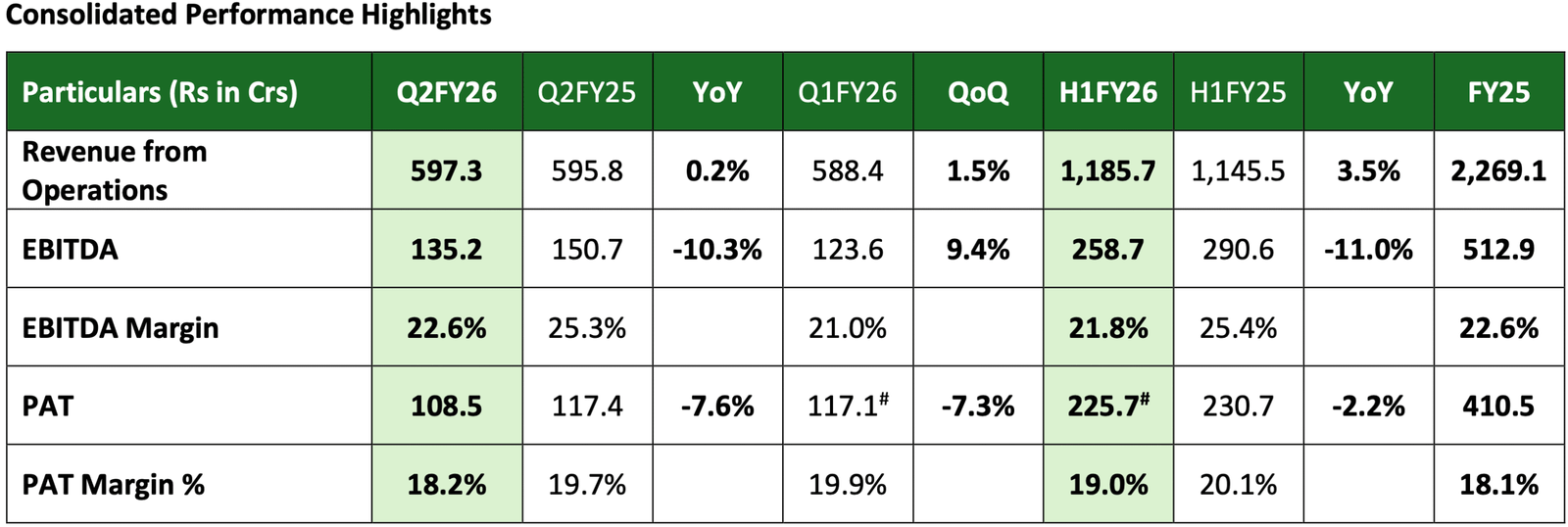

Q2 & H1FY26 Performance Highlights:

• Revenue Composition and Demand Trends

o Exports accounted for 55% for total revenue in Q2FY26 and H1FY26

o Overall demand remained stable during H1 FY26, with export markets showing steady performance and

domestic demand improving in Q2.

• Operating Environment and Cost Dynamics

o Raw material costs increased in H1 FY 26 as compared to H1 FY 25. There is a slight increase in raw

material prices in Q2 as compared to Q1.

o Freight costs remained stable throughout H1FY26

• Infusion of Equity in WOS Fine Organic Industries (SEZ) Private Limited

o During the quarter, the WOS Company issued Preference Shares amounting to ₹65 crore as part of its

equity capital structure.

• Strategic Expansion – United States Operations

o The Company incorporated a wholly owned subsidiary, Fine Organics Americas LLC, in the United States to

set up a manufacturing plant

o An equity investment of USD 1.12 mn (Rs ~9.6 cr) was made in June’25

o In July’25, the Company acquired ~159.9 acres of land in Jonesville, Union County, South Carolina, for

future expansion and manufacturing capabilities