Mumbai: Wanbury Ltd, a pharmaceutical company with a presence in the global API market and domestic branded formulations, has announced its financial results for the quarter and nine months ended 31st December 2025.

For the quarter ended December 31, 2025

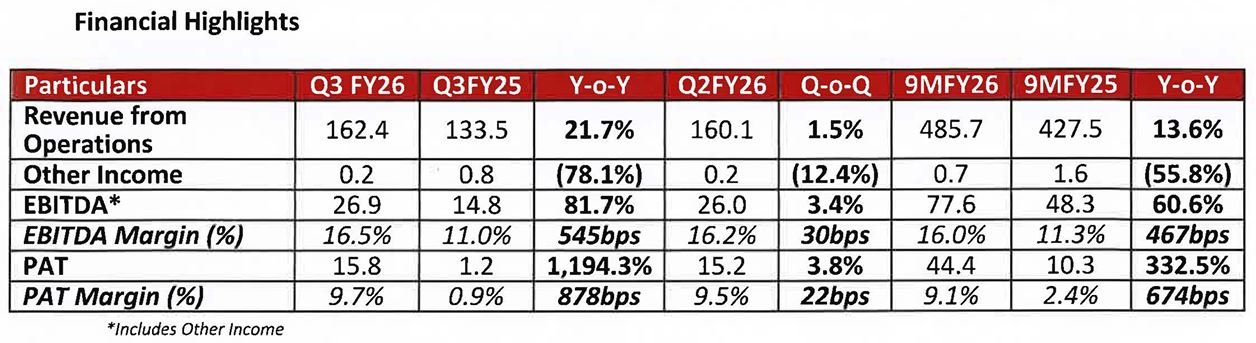

- Revenue from operations stood at Rs. 162.4 crore, compared to Rs. 133.5 crore in Q3 FY25, Y-o-Y growth of 21.7%, driven by higher API volumes, improved capacity utilization at key manufacturing facilities and steady performance in the formulations business.

- EBITDA (including other income) for the quarter stood at Rs. 26.9 crore, as compared to Rs. 14.8 crore in Q3 FY25, registering a growth of 81.7%, led by operating leverage, better procurement strategies, higher product yields, enhanced solvent recovery systems.

- EBITDA Margin stood at 16.5% compared to 11.0% in Q3 FY25

- PAT for the quarter stood at Rs. 15.8 crore, compared to Rs. 1.2 crore in Q3 FY25, registering a significant growth of 1,194.3%, driven by strong operating performance, margin expansion, improved cost efficiencies and lower finance costs.

- PAT Margin stood at 9.7% for Q3 FY26 compared to 0.9% for Q3 FY25 For the nine months ended December 31, 2025

- Revenue from operations for 9M FY26 stood at Rs. 485.7 crore, up from Rs. 427.5 crore in 9M FY25, reflecting a Y-o-Y growth of 13.6%, primarily led by volume growth in the Al’I business and stable pertormance at the tormulations segment.

- EBITDA (including other income) for 9M FY26 stood at Rs. 77.6 crore, compared to Rs. 48.3 crore in 9M FY25, a Y-o-Y growth of 60.6%, driven by sustained operational efficiencies, improved product mix, better capacity utilization and continued cost optimization initiatives

- EBITDA Margin stood at 16.0% compared to 11.3% in 9M FY25

- PAT for 9M FY26 stood at Rs. 44.4 crore, compared to Rs. 10.3 crore in 9M FY25, registering a growth of 332.5% operating leverage, improved financial discipline and reduced finance costs.

- PAT Margin stood at 9.1% for 9M FY26 compared to 2.4% for 9M FY25

Mohan Rayana, Director of Wanbury Ltd., said,

- Robust Revenue Growth: Q3FY26 revenue up 22% YoY; 9MFY26 up 14% YoY, driven by strong demand and higher volumes in AP/ and moderate growth in Formulations segments.

- Improved Profitability: Q3FY26 EB/TOA surged to 26.9Cr and 9MFY26 EB/TOA surged to 77.6Cr improvement of 81.7% YoY in Q3 and 60.6% YoY in 9MFY26 respectively. This was achieved through margin improvements majorly due sales of high margin SKUs, good product mix besides improved productivity due to higher yields, enhanced solvent recovery and improved procurement

- PAT Growth: Q3FY26 PAT improved to 15.8Cr from 1.2Cr in Q3FY25 and 9MFY26 PAT increased to 44.4Cr from 10.3Cr in 9MFY25, significant Profit After Tax growth from strong operations and from reduced finance costs.

- API Business Highlights: New product launch: Commercial invoicing and shipment to European customer completed for high potent anaesthetic AP/ from cutting edge Tanaku facility is completed in Q3FY26. Further with upcoming new product launches – Antidiabetic, Anticoagulant (Blood thinner}, Cough suppressant (Anti Tussive}, Antidepressant Wanbury is well positioned for growth in upcoming years.

- Formulations Progress: EB/TOA positive in Q3 and 9MFY26; witnessed good results from recent launch of nutritional supplement C-Red and other products; healthy pipeline for expansion into new therapeutic categories.