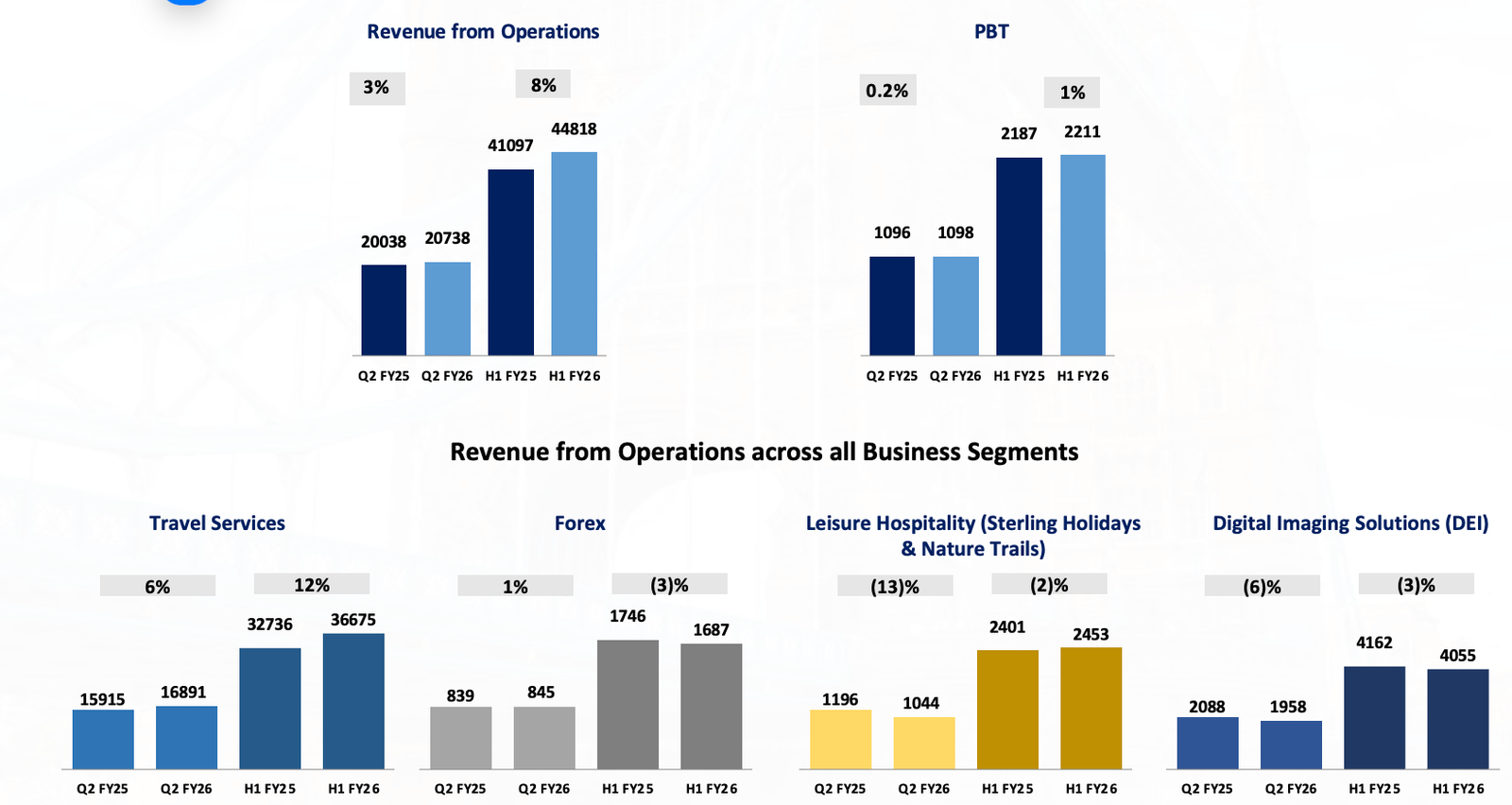

- PBT after exceptional items, maintained at Rs. 2,211 Mn in H1 FY26 vs Rs. 2,187 Mn in H1 FY25 and Rs. 1,098 Mn in Q2 FY26 vs Rs. 1,096 Mn in Q2 FY25, despite the headwinds posed by multiple challenging global geopolitical events and severe weather events in India

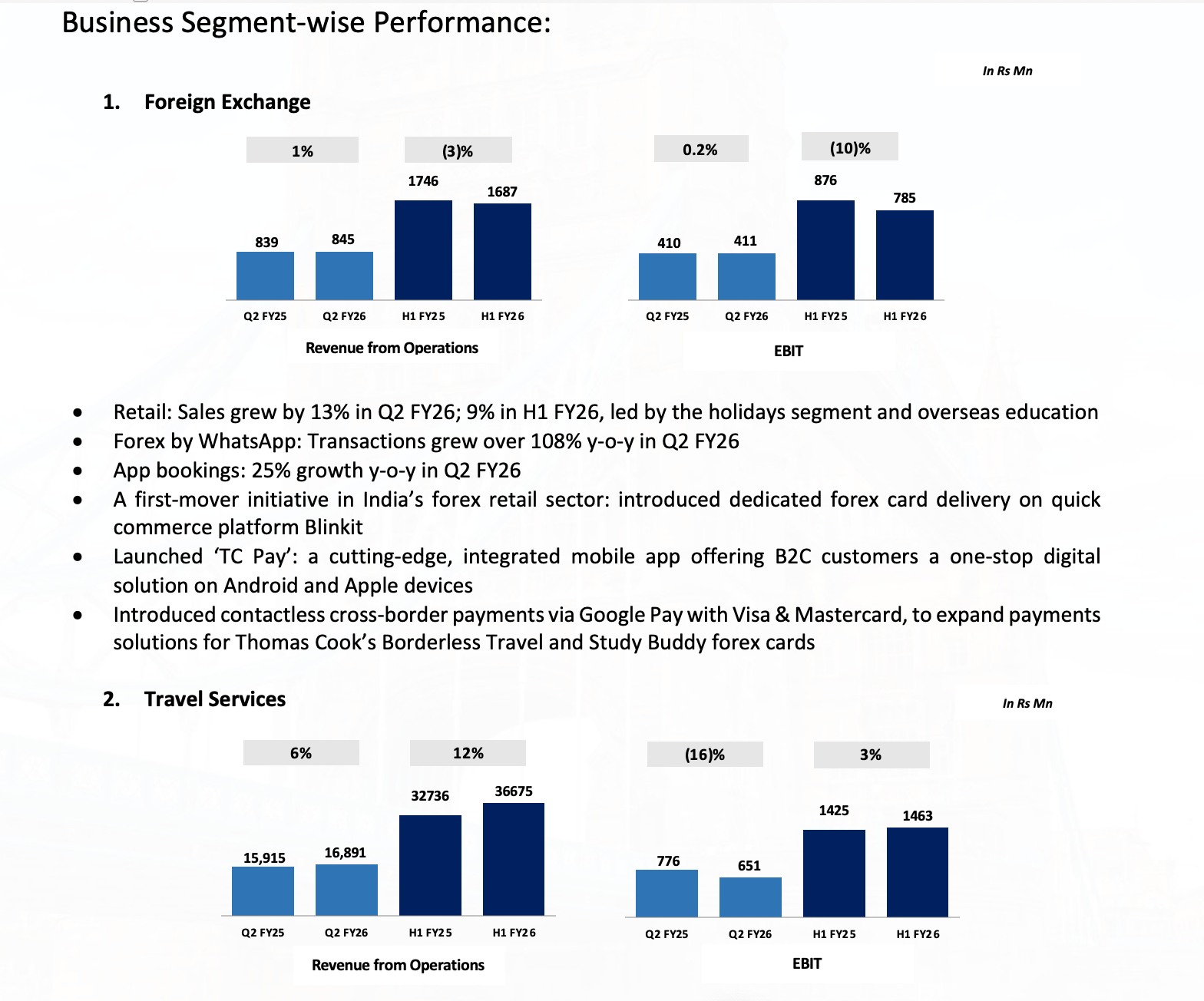

- Financial Services: Retail turnover increased by 13% y-o-y for Q2 FY26 and 9% y-o-y for H1 FY26, led by the holidays and overseas education segments, despite overall sluggish trading environment. Maintained healthy EBIT margins at 49% for Q2 FY26

- Travel Services: Revenue from Operations grew to 12% y-o-y in H1 FY26 and 6% y-o-y in Q2 FY26

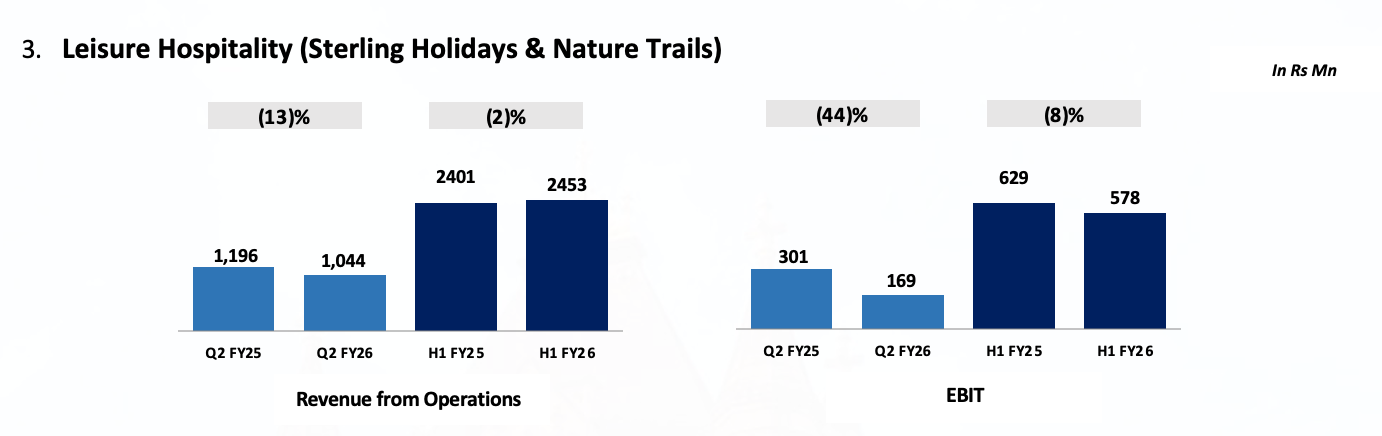

- Leisure Hospitality (Sterling Holidays): Weather & seasonality headwinds in Q2 impacted sales for the quarter. Sterling opened a record seven new properties during the quarter, after having opened 2 new resorts in the previous quarter. Profitability was, however, impacted by higher setup and operating costs for the new resorts and lower occupancy levels across the newly added inventory

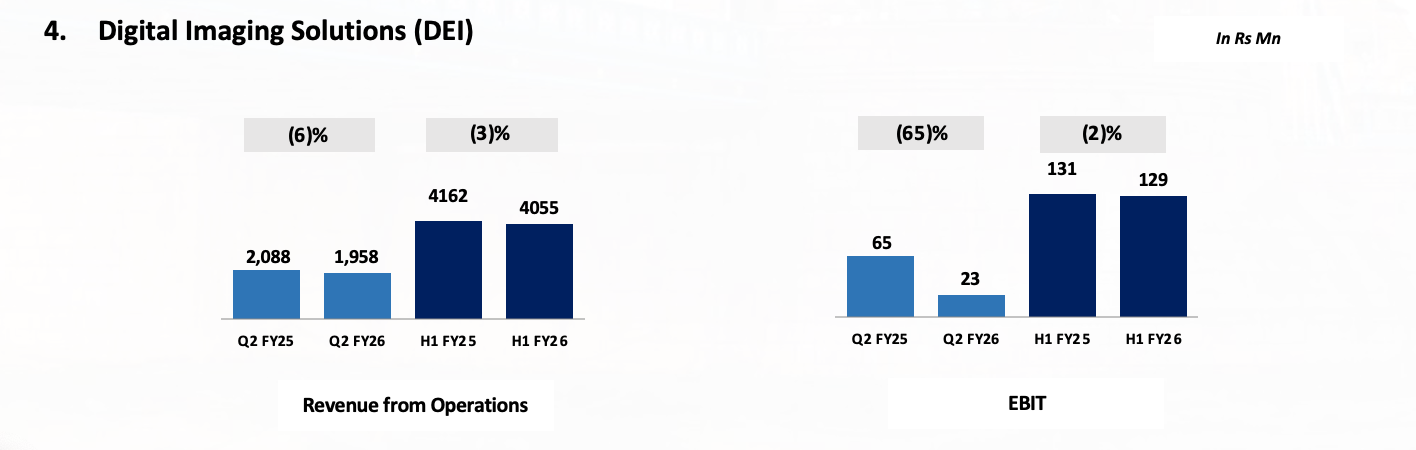

- Digiphoto Entertainment Imaging (DEI): Revenue from Operations declined by (3%) in H1 FY26 and (6%) in Q2 FY26, due to the geopolitical issues affecting home markets in the Middle East

- The Group continues to maintain a strong financial position, with Cash & Bank balances at Rs. 23,861 Mn as of September 30, 2025 vs Rs. 20,739 Mn as of March 31, 2025

- Thomas Cook India is the only Indian company to have won two awards at the prestigious Adam Smith Awards Asia 2025 – for Best Risk Management Solution and Best Investing Solution – for strong Treasury managemen

| Travel Services

· Leisure Travel: Growth in sales 7% y-o-y for Q2 FY26; 12% y-o-y for H1 FY26 · MICE: Growth in sales 2% y-o-y for Q2 FY26; 7% y-o-y for H1 FY26 · Corporate Travel: turnover 27% y-o-y for Q2 FY26; 14% y-o-y for H1 FY26 · India DMS: turnover (10)% y-o-y for Q2 FY26; 10% y-o-y for H1 FY26 · Overseas DMS: turnover 6% y-o-y for Q2 FY26; 16% y-o-y for H1 FY26 |

| Digital Imaging Solutions (DEI)

· Sales: (6)% y-o-y for Q2 FY2 · 9 new partnerships signed in Q2 FY26: UAE, Maldives, India · Renewed 8 key partnerships: across UAE, Indonesia, Malaysia, Maldives · Operational launch of 6 partnerships: UAE, Singapore, Hong Kong |

| Leisure Hospitality (Sterling Holidays & Nature Trails)

· Sales: (2)% y-o-y for H1 FY26; (13)% y-o-y for Q2 FY26 · ARR grew by 10% to Rs.5949 · F&B Revenue: 11% growth y-o-y · 7 new resorts launched in Q2 FY26: Dehradun, Kasauli, Vellore, Ayodhya, Malampuzha, Guruvayur, Sakleshpur |

| Forex

· Retail growth: 13% y-o-y for Q2 FY26; 9% y-o-y for H1 FY26 · Holiday sales growth: 13% y-o-y for Q2 FY26, 9% y-o-y for H1 FY26 · Overseas Education growth: 9% y-o-y for Q2 FY26: 6% y-o-y for H1 FY26 · WhatsApp transactions growth: 108% y-o-y for H1 FY26 · Introduced payments via Google Pay with Visa & Mastercard; launched TC Pay – integrated B2C app; tie-up with Q-comm platform Blinkit for delivery of forex cards

|

Mahesh Iyer, Managing Director & CEO Thomas Cook (India) Limited said, “While multiple global geopolitical challenges and monsoon-related disruptions affected India’s travel sector this quarter, the TCIL Group has demonstrated resilience – growing Revenue from Operations by 9% for H1 & 3% for the quarter, as well as sustaining PBT at Rs. 2,211 Mn in H1 FY26. Despite RBI’s LRS data reflecting a slowdown, particularly in the education segment – our forex business has managed to increase retail sales by 9% in H1 FY26.

Looking ahead, we believe that initiatives of the government such as GST 2.0 and other growth-led investments will benefit the travel industry as the consumption led trickle down effect will lead to higher discretionary category spends.”

- Meetings-Incentives-Conferences-Exhibitions (MICE)

- Managed over 200 groups of 50 to over 3000 delegates per group. Key international destinations: Europe, Australia, UAE, UK, USA and Asia. Domestic: Goa, Jaipur, Mumbai, Delhi, Kolkata, Hyderabad

- Thomas Cook India successfully managed 200+ delegates for the International Solar Alliance Regional Committee Programme (Latin America) held in Santiago (Chile) – the country’s first large-scale diplomatic event, facilitating bilateral meetings with the Honorable Energy Minister of Chile and various global ambassadors and diplomats

- Managed 300+ delegates in Accra (Ghana) for International Solar Alliance Regional Committee Programme (Africa), inaugurated by the President of Ghana, facilitating meetings and site visits with various global ambassadors and diplomats

- Thomas Cook India successfully managed the Asian Aquatic Championships 2025 in Ahmedabad as the exclusive partner for transport and accommodation for a strong 1100+ contingent, including over 650+ athletes, 60+ support staff and dignitaries from 29 Asian nationalities

- Leisure Travel

- Thomas Cook India & SOTC Travel launched Festival and Carnival tours – unique holidays around global and Indian cultural celebrations to maximise on this growing trend

- Deepened focus on Spiritual Tourism leveraging strong demand with a diverse range of pilgrimages across India & the Subcontinent

- Restarted the Kailash Mansarovar Yatra for the first time since Covid-19

- Introduced special regional Festival Tours during Durga Puja, Dussehra, Diwali – domestic & outbound

- Expanded partnership with Disney Cruise Line to launch premium Australia & New Zealand sailings as part of the Companies group tours & customized holidays for Winter 2025-26

- Destination Management Services (DMS) Network

- India DMS:

10% decline in sales for Q2 FY26, attributed to recent protests in Nepal, along with reduced source market performance impacted by advisories issued during the India–Pakistan conflict

- Overseas DMS: Sales grew by 6% y-o-y for Q2 FY26, despite the quarter being a traditionally low season for the business

- Asia Pacific – Asian Trails: Reported 18% y-o-y growth in sales in the quarter, driven by strong contributions from key markets including Thailand, Indonesia, Malaysia, Vietnam, and Australia. Improved margins were achieved through cost optimization initiatives, particularly in Thailand

- USA – Allied T Pro: Q2 turnover growth was subdued, however earnings remained strong supported by disciplined cost management and operational efficiencies. For USA, a normally strong quarter was affected by a shift in sentiment and weaker bookings, reflecting broader geopolitical uncertainty and resulting in muted inbound traffic

- Middle East – Desert Adventures: Revenue declined during the quarter, which is typically a low season for the region, and was further impacted by geo-political developments. The business focused on maintaining competitiveness through strategic pricing initiatives, particularly in the FIT segment

- Private Safaris:

- Southern Africa: The business achieved 38% y-o-y growth in sales in the quarter, driven by peak tourism season in South Africa and successful upselling within its tour series.

- East Africa: Q2 FY26, was a strong operational period, with sales improving 12% y-o-y, supported by demand from key markets such as the USA and India

- Revenue at Rs 1044 Mn powered by Room and F&B growth from an expanded inventory base

- Room revenue grew by 22% in Q2 FY26: F&B revenue grew at 11%; Management Contract Revenues grew at 22%

- Resort Network: Added 7 new Sterling Holiday Resorts across 7 locations in Q2 FY26. The total network (including Nature Trails) stands at 69 properties with 3506 rooms

- Guest ratio of non-members grew to 75% in Q2 FY26

- Growth in ARR by 10% at Rs. 5949 and resort occupancy at 49% in Q2 FY26

- Weather & Seasonality headwinds in Q2: Excess rainfall in Himachal and Uttarakhand impacted ~21% of resorts; no Saya dates impacting Rajasthan (12% of resorts) and jungle closures (21% of resorts)

- Healthy operating free cash flow growth at 62% with Cash surplus rising by 51% over the previous year, despite cease in new membership acquisitions

- Guest satisfaction: TripAdvisor rating up to 4.61 vs 4.57 LY

Nature Trails

- Revenue grew by 14% y-o-y in Q2 FY26

- Corporate business reported a strong 86% y-o-y growth; the school/college segment recorded a 15% growth for the quarter

- Signed two new properties – Dodamarg and Rishikesh — under management contracts, both scheduled to be operational in Q3 FY26

- Added inventory at Nature Trails – Durshet, 14 rooms, new swimming pool and a conference facility to enhance guest experience

- Improved guest satisfaction scores (Google – 4.2) and repeat visit ratio through service and facility enhancements

- Successfully hosted the Durshet Marathon in August with participation from over 650 runners, strengthening local community engagement and brand visibility

- Launched sustainability initiatives across Nature Trail properties, focusing on waste reduction and eco-friendly practices

- Sales declined by 6% y-o-y for Q2 FY26, primarily due to attendance shortfalls in the UAE and Malaysia, revenue loss in Hong Kong following an exit, and an unplanned closure of a key venue in Singapore for upgradation

- WeC Software: More than 80% of the locations have gone live with WeC in this quarter

- 9 new partnerships signed in Q2 FY26: UAE (Ain Dubai, Dubai Miracle Garden, Zeta Seventy Seven, Butterfly Gardens Abu Dhabi, RTA Marine Ferry) and Maldives (Coco Bodu Hithi, Constance Moofushi, Royal Island), along with expansion into India (Black Thunder Waterpark)

- Renewed 8 key partnerships: Malaysia (KL Tower), Indonesia (Wahoo Waterworld, Jumeirah Bali, Ayodya Resort Bali), Maldives (Le Méridien Maldives ), UAE (The National Aquarium Abu Dhabi, Aura Sky Pool), Oman ( Snow Oman)

- Operational launch of 6 partnerships: UAE (Dubai Miracle Garden, Zeta Seventy Seven, RTA Marine Ferry), Singapore (Singapore Oceanarium, Marine Mammal Habitat), and Hong Kong (Ocean Park)

Other Key Business Updates

- Focus on Digitalization

- TravelOne & Dhruv.ai: launched an AI-powered corporate booking platform for flights and travel insurance, offering touchless booking via voice and email, policy configuration, real-time updates, credit limit management, invoicing and self-service. Additionally the tool includes a self-service feature for employees of TCIL and SOTC

- Tour Manager App: an all-in-one platform for Leisure and MICE Tour Managers with comprehensive itinerary management, passenger connect tools and efficient expense management

- Customer Self Service App: enhanced the existing CSS app with features for MICE customers with smart tools like self-registration, documentation, itinerary access, travel and stay details

- MICE Corporate Service Portal: a personalized portal offering for MICE Operations teams to seamlessly manage their respective group activations, itinerary planning, document upload, broadcasts & notification, invoicing and receipt management

- India Network Expansions

Leisure Travel: 4 outlets across Thomas Cook India and SOTC opened in Q2 FY26 in Davangere, Kanpur, NCR and Kozhikode

- Awards and Partnerships

- Thomas Cook India, only Indian company to win Highly Commended Winner in two categories – Best Risk Management Solution and Best Investing Solution at the Adam Smith Awards 2025

- Thomas Cook honoured at the prestigious India Travel Awards 2025

- SOTC Travel – Best Integrated Marketing Campaign award at the PATA Gold Awards 2025

- Thomas Cook India and SOTC Travel signed a long-term, multi-pronged MOU with Queensland Tourism (Tourism and Events Queensland)

- Thomas Cook India signed an MOU with the Ministry of Tourism (MoT), Government of India to conduct a nationwide traveller sentiment survey aimed at enhancing destination experiences across India