Coimbatore: Salzer Electronics Limited (BSE: 517059, NSE: SALZERELEC), a capital goods engineering Companyoffering total and customised electrical solutions, announced its unaudited financial results for the Second quarter and half year ended 30% September 2025.

Rajesh Doraiswamy, Joint Managing Director, Salzer Electronics Ltd said: “During the Second quarter of the financial year, we delivered a resilient performance, reporting consolidated revenues of 418.9 crore, a growth of 21.7% year-on-year, driven by robust traction across our core businesses and accelerated ramp-up of the smart meter segment. Our Smart Meter business achieved sales of 22 crore during Q2, taking the total to %24 crore in the first half — reflecting our strong execution capability and growing presence in the energy management space.

While the quarter witnessed margin moderation to 8.7%, largely due to higher input costs and initial scaling expenses in the new segment, we remain confident of an improvement in profitability as volumes grow and operating efficiencies strengthen in the coming quarters. The steady performance of our switchgear and wire & cable divisions, continues to be a strong backbone of our business.

During the quarter, we continued to focus on operational efficiency, working capital optimization, and expanding our product portfolio in line with the evolving industry landscape. With the government’s continued push on smart metering and infrastructure modernization, Salzer is well positioned to capture long-term growth opportunities through innovation, quality, and customer-centricity.”

Rajesh Doraiswamy further said, “Moreover, we are proud to have been granted a patent for our ‘Disconnecting and Earthing Device for High Voltage Applications.’ This innovation is a significant step forward in enhancing safety and efficiency for traction, locomotive, and other high-voltage systems. It reflects our continued commitment to engineering excellence and developing indigenous solutions that add real value to our customers and the power industry at large.

Looking ahead, we aim to sustain double-digit revenue growth for the full year with a focus on improving margins, scaling our smart metering operations, and strengthening our leadership position in the electrical and automation solutions space.

| thank the entire team at Salzer Electronics for their untiring efforts and all our stakeholders for their continued support and faith in our Company.”

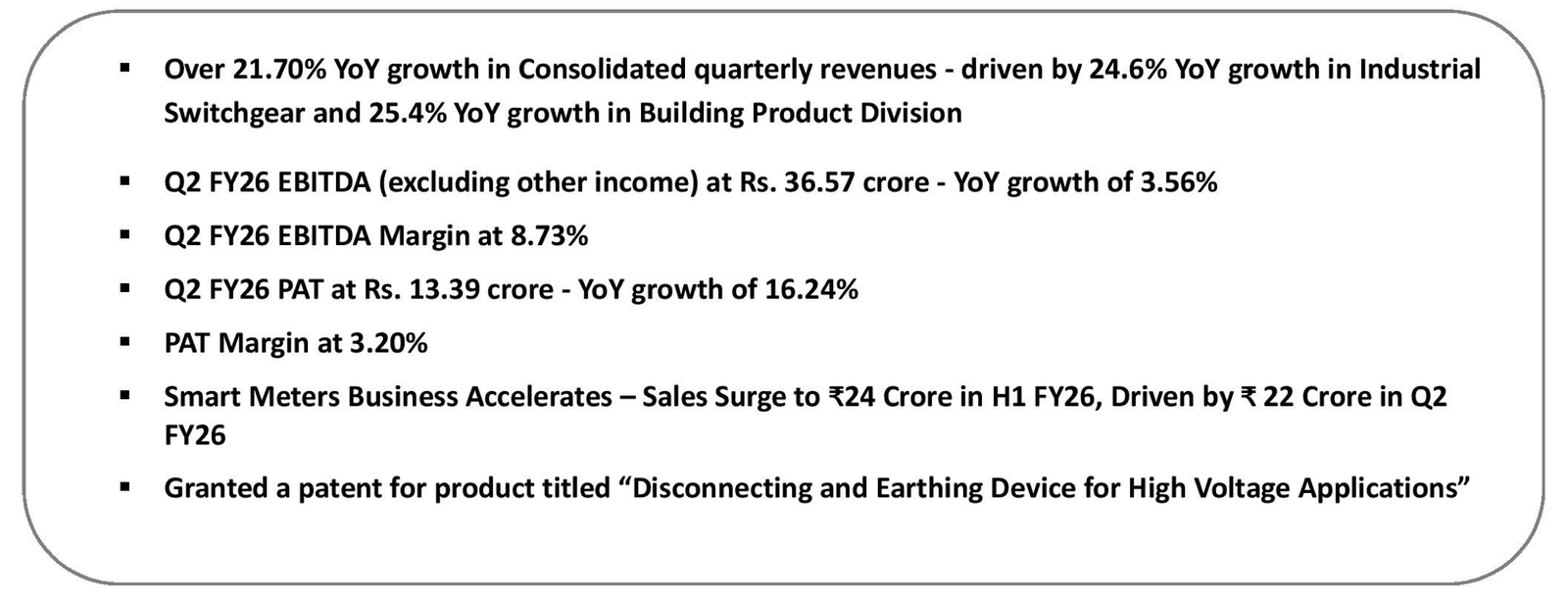

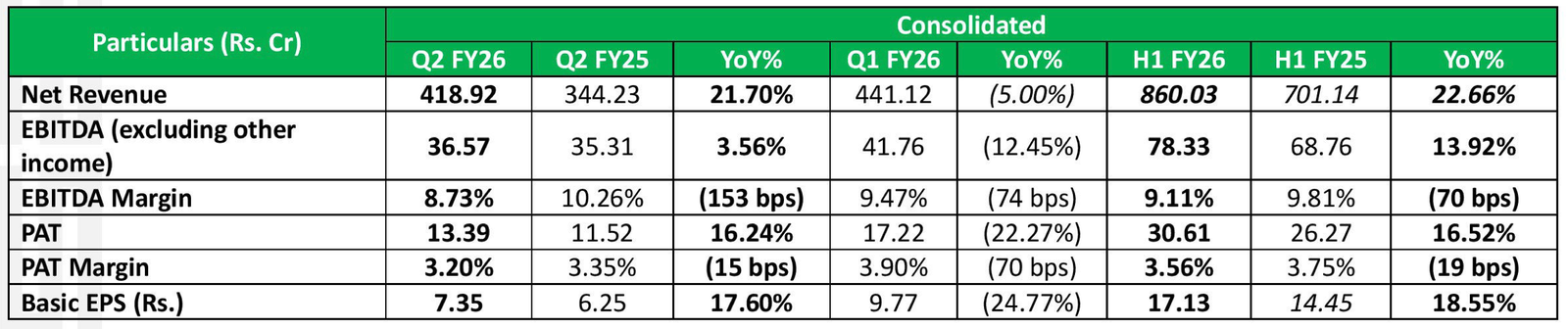

Consolidated Financial Performance Highlights

For the Quarter ended September 30‘, 2025:

= Net Revenue in Q2 FY26 was Rs. 418.92 crore as against Rs. 344.23 crore in Q2 FY25, YoY growth of 21.70%. This growth was mainly

driven by higher demand for Industrial switchgear and Building products division businesses mainly due to high demand products like three phase transformers, wire harness, relays and new product like contactors etc.

Contribution from Exports at 23.79%

- EBITDA (excluding other income) was Rs. 36.57 crore in Q2 FY26 as against Rs. 35.31 crore in Q2 FY25, YoY growth of 3.56%, on account of increased sales, especially in Switchgear and Building products segments.

- EBITDA Margin for the quarter stood at 8.73%. Higher input costs and initial scaling up expenses exerted pressure on margins.

- Profit After Tax at Rs. 13.39 crore in Q2 FY26 as against Rs. 11.52 crore in Q2 FY25

- PAT Margin for the quarter stood at 3.20%

For the Half year ended September 30*, 2025:

Net Revenue in H1 FY26 was Rs. 860.03 crore as against Rs. 701.14 crore in H1 FY25, YoY growth of 22.66%. This growth was mainlydriven by higher demand for Industrial switchgear and Building product division businesses mainly due to high demand products like three phase transformers, wire harness, relays and new product like contactors etc.

-Contribution from Exports at 24.0%, export revenue grew 7.0% YoY in H1 FY26, driven by higher sales from Europe and Asian countries.

EBITDA (excluding other income) was Rs. 78.33 crore in H1 FY26 as against Rs. 68.76 crore in H1 FY25, YoY growth of 13.92% On account of increased sales in the Switchgear products and Building products business divisions

- EBITDA Margin for the quarter stood at 9.11%

- Profit After Tax at Rs. 30.61 crore in H1 FY26 as against Rs. 26.27 crore in H1 FY25, YoY growth of 16.52%.

- PAT Margin for the quarter stood at 3.56%

Q2 FY26 performance highlights of the key businesses of Salzer Electronics Limited: Industrial Switch Gear Division:

Industrial Switchgear business division comprises of LOW voltage products such as Toroidal Transformers, Three phase transformers, Rotary Switches, Isolators, General Purpose relays, Wire Harness, Wiring Ducts, MPCB’s, Contactors & OLR’s, Control Panels, Terminal Blocks, and Sensors. This division offers around 15 products that are all internationally certified

This business grew 24.61% YoY and contributed 63.11% to the total revenues in this quarter and grew 27.70% YoY in H1 FY26, contributed 58.72% to the total revenues in the first half year ended.

The EBIDTA Margin in this business was 11.12% in Q2 FY26 and 12.37% in H1 FY26

Wire & Cables Division:

Wires & Cables business division comprises of LOW-voltage products such as Wires & Cables, Flexible Bus Bars, Enamelled Wires, Bunched Conductors and Tinned Copper Wires

This business division contributed 31.83% to the total revenues this quarter and 36.43% in H1 FY26. This division grew 15.43% YoY in Q2 FY26 and 16.36% YoY in H1 FY26.

This Division’s EBIDTA Margin stood at 5.55% in Q2 FY26 and 5.36% in H1 FY26.

Building Products Division:

Building Electrical Products division comprises of products such as Modular Switches, Wires & Cables, MCB’s Distribution Boards and Changeovers.

This division contributed 5.06% to the total revenue in this quarter and 4.85% in H1 FY26. This division grew 25.42% YoY in Q2 FY26 and 23.07% YoY in H1 FY26.