Greater Noida: Laxmi India Finance Ltd. (NSE Code: LAXMIINDIA) announced its financial results for the quarter and nine months ended December 31st, 2025, reflecting strong business growth, healthy operating metrics, and robust capital adequacy, notwithstanding a one-time stress event in a Direct Assignment (DA) loan pool.

Operational and Financial Highlights – Q3 FY26

- Assets Under Management (AUM) grew 21.11% YoY to ₹ 1,451.10 crore as of December 31st, 2025 compared to ₹ 1198.12 crore as on December 31st, 2024.

- Own Book expanded 23.68% YoY to ₹ 1,365.02 crore vs ₹ 1,103.64 crore, reflecting steady portfolio scaling.

- Yield on Average Portfolio improved to 21.76% vs 21.50% YoY, supported by disciplined pricing.

- Average Cost of Borrowings declined to 10.94% vs 11.58% YoY, improving spread sustainability.

- Capital Adequacy (CRAR) strengthened significantly to 28.40% as against 20.76% ending Q3 FY25, providing ample growth headroom.

- Return on Average Assets (RoA) remained stable at 2.53%; Return on Equity (RoE) stood at 11.04%

Profitability Snapshot – Q3 and 9M FY26

Asset Quality & Risk Metrics

- Gross NPA stood at 2.40% as of December 31st, 2025; Net NPA stood at 1.24%

Provision Coverage Ratio (Stage 3) improved to 49.19% vs 46.25% YoY

Credit Cost remained contained at 1.23% vs 1.03% YoY

Employee benefit expenses during the quarter include a one-time provision of ₹0.45 crore towards

implementation of the new labour codes.

Update on Direct Assignment (DA) Portfolio

The Company acquired two loan pools under Direct Assignment transactions during January 2025 and July

2025, aggregating ₹ 25.12 crore. During Q3 FY26, DA partner encountered unexpected financial stress,

resulting in non-receipt of EMIs. In line with RBI prudential norms, the affected accounts remaining overdue

beyond 90 days were classified as NPAs as of December 31st, 2025, and necessary provisions were recognized

under Ind AS. This event was unforeseen and external, and the Company has taken all required accounting

and risk actions promptly and transparently.

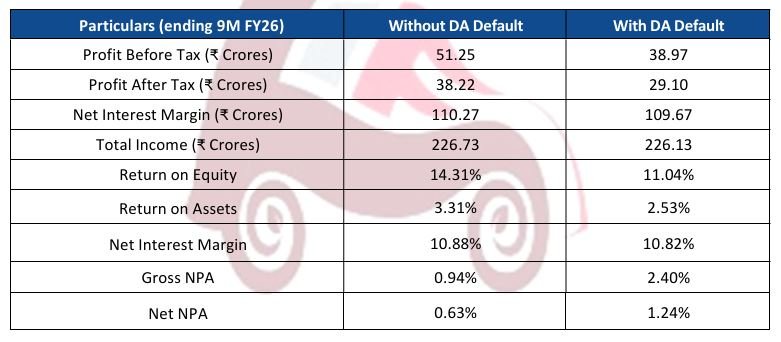

Underlying Performance (Excluding DA Stress Event)

Had the above DA-related event not occurred, the Company’s financial performance for the nine months

ended December 31st, 2025 would have been as follows: