Mumbai: Laxmi Dental Limited (BSE – 544339, NSE – LAXMIDENTL), a leading integrated dental products company, announced its unaudited Financial Results for the quarter and nine months ended December 31st, 2025.

Consolidated Result Highlights

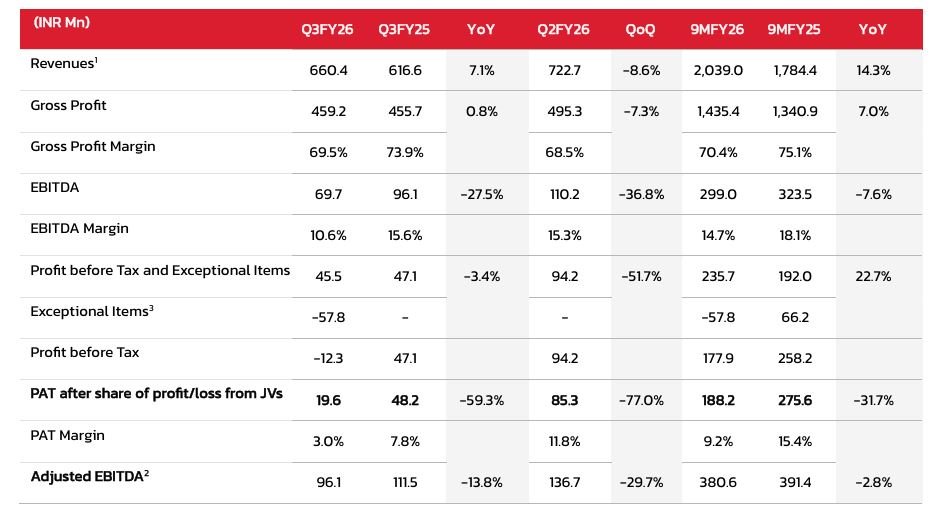

• Revenue grew by 7.1% YoY despite a challenging global environment owing to uncertainties around the macroeconomic as well as geopolitical situations

• Gross profit margins stood at 69.5%, which is a minor improvement sequentially due to a relatively lower sale mix contribution from scanner sales, which usually comes at a lower margin

- Scanner sales are strategic in nature and act as an enabler for future growth in Dental Lab and Aligner business

• Gross profit margins in the laboratory business as well as Aligner business remain steady

• Additionally, Q3FY26 had a full quarter impact of ~150 bps on account of higher US tariffs

• Based on the requirements of the New Labour Codes, the company recorded an incremental impact of INR 5.8 cr as an Exceptional Item for the quarter

• ESOP expenses, which are non-cash in nature, stood at INR 16.14 Mn for Q3FY26 and it is expected to be INR 61.3 Mn for FY26

• Kids-E-Dental revenue stood at INR 59 Mn and is expected to deliver healthy growth starting next year onwards

• The company accounted for INR 32.2 Mn deferred tax credit on account of the US subsidiary achieving consistent profits

• INR 66.2 Mn worth of exceptional Item pertaining to gain on property sale was recorded in Q1FY25. Therefore, 9M FY25 is a non-comparable higher base.

Rajesh Khakhar, Chairperson and Whole-Time Director said, “In Q3FY26, the company delivered revenues of INR 660 Mn as against INR 61.7 cr in same period last year, recording a YoY growth of 7%. The performance is despite global macroeconomic and geopolitical challenges, underscoring the strength and resilience of our diversified portfolio. Gross profit margins witnessed minor improvement sequentially due to steady profitability in the laboratory and aligner business alongside a relatively lower contribution of scanner sales, which are low margin in nature. Scanner sales hold strategic importance for future growth across segments.

During Q3, we had a full quarter impact of 150 bps on account of higher US tariffs. Additionally, we recorded a one-time exceptional provision of INR 58 Mn towards gratuity past service liability under the new labour code.

With US tariff normalization, positive development of EU FTA, multiple ongoing strategic initiatives, and consolidation in the domestic dental market, Laxmi Dental is well positioned to deliver resilient, industry-leading growth along with improved profitability going ahead.”

Sameer Merchant, Managing Director and CEO said, ““For Q3FY26, our Dental lab business recorded a decent YoY growth of 10.4%, with international business delivering robust 25.5% YoY growth, while the domestic lab remained soft. Towards this, we have implemented innovative strategies in the quarter, and that has started showing positive

results in the month of January 2026. Within the Aligner Solutions business, the competitive pricing pressures on Bizdent is getting normalized in the running quarter, Q4FY26, and we anticipate the situation to remain positive for the entire quarter.

With the new strategic initiatives, we are seeing a strong recovery in our domestic dental lab and Bizdent businesses, and we expect both these segments to deliver robust YoY performance in Q4FY26.

On the back of these positive trends, we expect to close FY26 with a healthy exit quarter and begin FY27 on a stronger footing. Over long-term, we remain committed towards promoting digital dentistry and spearheading this revolution for the entire dental industry in India on the back of our scanner solutions.”