Hyderabad: The Board of Directors of Kotak Mahindra Bank approved the unaudited standalone and consolidated results for the quarter and nine-months ended December 31, 2025, at the Board meeting held in Hyderabad, on Saturday.

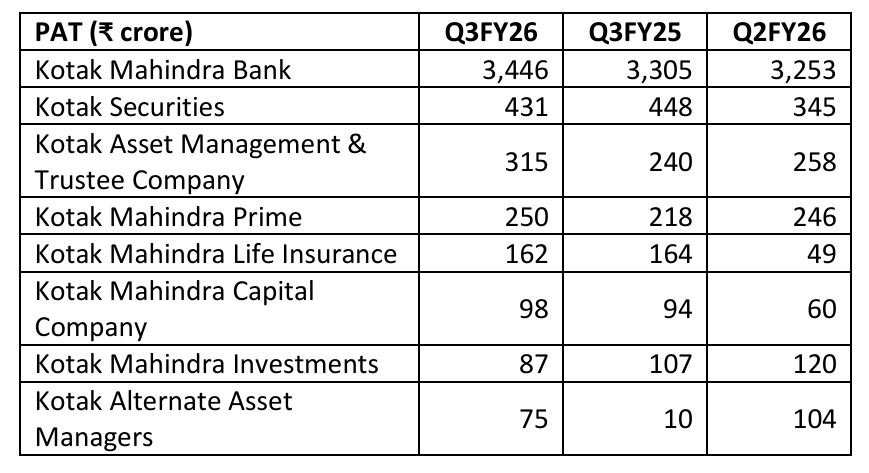

Consolidated results at a glance

Consolidated PAT for Q3FY26 stood at ₹ 4,924 crore, up 5% YoY from ₹ 4,701 crore in Q3FY25 (up 10% QoQ

from ₹ 4,468 crore in Q2FY26). Q3FY26 consolidated PAT includes estimated incremental cost of ₹ 98 crore

(post tax) pursuant to new Labour Code.

PAT of Bank and key subsidiaries given below:

Consolidated Customer Assets which comprise Advances (incl. IBPC & BRDS) and Credit Substitutes grew to ₹598,780 crore as at December 31, 2025, up 15% YoY from ₹ 519,126 crore as at December 31, 2024.

Total Customer Assets Under Management as at December 31, 2025 grew to ₹ 787,950 crore, up 15% YoY from ₹ 685,134 crore as at December 31, 2024. The total Domestic MF AUM increased by 20% YoY to ₹ 586,610 crore as at December 31, 2025.

Consolidated Networth as at December 31, 2025 was ₹ 175,251 crore. The Book Value per Share increased to ₹ 176 as at December 31, 2025, up 15% YoY from ₹ 154 as at December 31, 2024 (computed based on subdivision of 1 equity share of face value of ₹ 5 each into 5 equity shares of ₹ 1 each with effect from 14th January, 2026).

At the consolidated level, Return on Assets (ROA) for Q3FY26 (annualized) was 2.10%. Return on Equity (ROE) for Q3FY26 (annualized) was 11.39%.

Consolidated Capital Adequacy Ratio as per Basel III as at December 31, 2025 was 23.3% and CET I ratio was 22.4% (including unaudited profits).

Average Liqudity Coverage Ratio stood at 135% for Q3FY26.

Kotak Mahindra Bank standalone results

Net Advances increased 16% YoY to ₹ 480,673 crore as at December 31, 2025 from ₹ 413,839 crore as at December 31, 2024. Customer Assets which comprise Advances (incl. IBPC & BRDS) and Credit Substitutes grew to ₹ 529,455 crore as at December 31, 2025, up 15% YoY from ₹ 459,436 crore as at December 31, 2024 Total period-end Deposits grew to ₹ 542,638 crore for Q3FY26, up 15% YoY from ₹ 473,497 crore for Q3FY25.

Average Total Deposits grew to ₹ 526,025 crore for Q3FY26, up 15% YoY from ₹ 458,614 crore for Q3FY25.

Average Current Deposits grew to ₹ 75,596 crore for Q3FY26, up 14% YoY from ₹ 66,589 crore for Q3FY25.

Average Fixed rate Savings Deposits grew to ₹ 118,505 crore for Q3FY26, up 12% YoY from ₹ 105,682 crore for

Q3FY25.

Average Term Deposits grew to ₹ 318,070 crore for Q3FY26, up 19% YoY from ₹ 267,743 crore for Q3FY25.

CASA ratio as at December 31, 2025 stood at 41.3%.

Cost of funds was 4.54% for Q3FY26 (5.06% for Q3FY25 and 4.70% for Q2FY26).

Credit to Deposit ratio as at December 31, 2025 stood at 88.6%.

Customers as on December 31, 2025 were 5.1 crore.

Net Interest Income (NII) for Q3FY26 increased to ₹ 7,565 crore, up 5% YoY from ₹ 7,196 crore in Q3FY25 (up

3% QoQ from ₹ 7,311 crore in Q2FY26).

Net Interest Margin (NIM) was 4.54% for Q3FY26 (4.93% for Q3FY25 and 4.54% for Q2FY26).

Fees and services for Q3FY26 increased to ₹ 2,549 crore, up 8% YoY from ₹ 2,362 crore in Q3FY25 (up 6% QoQ from ₹ 2,415 crore in Q2FY26).

Operating expenses for Q3FY26 increased to ₹ 5,023 crore, up 8% YoY from ₹ 4,638 crore in Q3FY25 (up 8% QoQ from ₹ 4,632 crore in Q2FY26). Q3FY26 operating expenses include an estimated incremental cost of ₹ 96 crore pursuant to new Labour Code. Excluding the impact of incremental cost due to new Labour Code, operating expenses for Q3FY26 were ₹ 4,927 crore, up 6% YoY (up 6% QoQ). Cost to income was 48.3% for Q3FY26 which excluding the impact of incremental cost pursuant to new Labour Code was 47.4% for Q3FY26.

Operating profit for Q3FY26 increased to ₹ 5,380 crore, up 4% YoY from ₹ 5,181 crore in Q3FY25 (up 2% QoQ from ₹ 5,268 crore in Q2FY26).

Provisions for Q3FY26 was ₹ 810 crore (₹ 794 crore in Q3FY25 and ₹ 947 crore in Q2FY26). Credit cost (annualised) for Q3FY26 stood at 0.63% (0.68% for Q3FY25 and 0.79% for Q2FY26).

The Bank’s PAT for Q3FY26 increased to ₹ 3,446 crore, up 4% YoY from ₹ 3,305 crore in Q3FY25 (up 6% QoQ from ₹ 3,253 crore in Q2FY26).

As at December 31, 2025, GNPA was 1.30% & NNPA was 0.31% (GNPA was 1.50% & NNPA was 0.41% at December 31, 2024). As at December 31, 2025, Provision Coverage Ratio stood at 76%.

Standalone Return on Assets (ROA) for Q3FY26 (annualized) was 1.89%. Return on Equity (ROE) for Q3FY26 (annualised) was 10.68%.

Capital Adequacy Ratio of the Bank, as per Basel III, as at December 31, 2025 was 22.6% and CET1 ratio of 21.5% (including unaudited profits).

The financial statements of Indian subsidiaries (excluding insurance companies) and associates are prepared as per Indian Accounting Standards in accordance with the Companies (Indian Accounting Standards) Rules, 2015.

The financial statements of subsidiaries located outside India are prepared in accordance with accounting principles generally accepted in their respective countries. However, for the purpose of preparation of the consolidated financial results, the results of subsidiaries and associates are in accordance with Generally Accepted Accounting Principles in India (‘GAAP’) specified under Section 133 and relevant provision of Companies Act, 2013.