Mumbai: Anand Rathi Share and Stock Brokers Limited (BSE:544530) (NSE:ARSSBL}, announced its unaudited consolidated financial results for the quarter and nine months period ended December 31, 2025.

Pradeep Gupta, Chairman and Managing Director, said: ” The Indian capital markets had a rough ride in FY26, with the Sensex and Nifty delivering lacklustre gains; under-performing other significant global peers. There was pressure from sustained selling by foreign investors, citing concerns over weak earnings, stretched valuations and currency volatility, which resulted in the benchmark indices remaining subdued despite brief mid-year rallies.

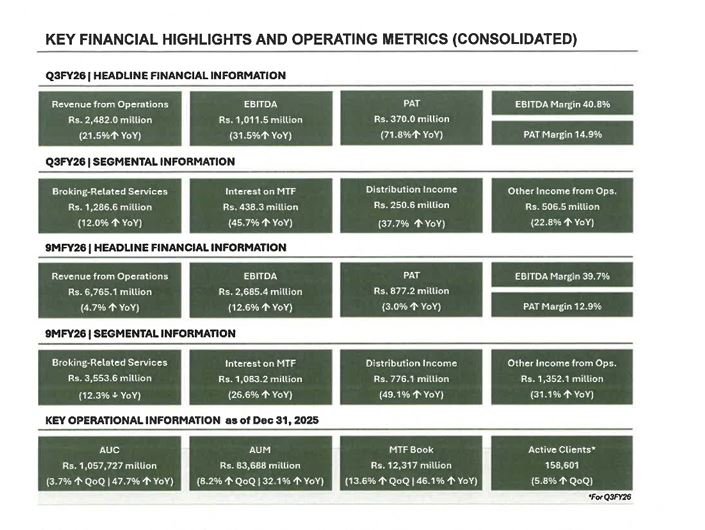

Despite this backdrop, our business continued to grow. We delivered strong broking revenues, with Assets under Custody rising 48% year-on-year to f1.06 trillion, an affirmation of our clients’ trust and our disciplined approach to financial stewardship. Our non-broking businesses also registered meaningful growth, with the MTF book expanding 46% YoY to f12,317 million and Assets under Management increasing 32% Yo Y to f83, 688 million. We will continue our focus on de-risking and stabilizing our earnings through increased exposure in the non-broking segments. In the era of discount and algorithm broking, we remain customer-oriented and our approach will always be relationship-based which is why over 54% of our clients have been with us since longer than 3 years. We take great pride in the enduring relationships that we have built – an affirmation about the consistency of our service, the relevance of our offerings and the stren th of our brand.”

Roop Kishor Bhootra, Wholetime Director, added: “We are pleased to begin the new calendar

year on a strong note, report.ing robust growth in Q3FY26. Total revenue from operations rose 21% YoYto (2,482 million, while EB/TOA rose 32% YoYto (1,012 million. Our bottom line surged 72% Yo Y to (370 million, delivering a healthy PAT margin of 14. 9% and a record EB/TOA margin of

40.8%. The core broking business remains resilient, with revenue climbing 12% YoY to (1,287

million. In the non-broking segment, interest income from MTF and Distribution income rose 43%

Yo Y to (689 million, reaffirming the strength of our diversified strategy and the high potential of

this segment. We added 5 branches during the quart.er taking our footprint to 97 branches across

the country thereby continuing to focus on disciplined execution and consistent sustainable

growth.”

Roop Kishor Bhootra, Wholetime Director, added: “We are pleased to begin the new calendar

year on a strong note, report.ing robust growth in Q3FY26. Total revenue from operations rose 21% YoYto (2,482 million, while EB/TOA rose 32% YoYto (1,012 million. Our bottom line surged 72% Yo Y to (370 million, delivering a healthy PAT margin of 14. 9% and a record EB/TOA margin of

40.8%. The core broking business remains resilient, with revenue climbing 12% YoY to (1,287 million. In the non-broking segment, interest income from MTF and Distribution income rose 43%

Yo Y to (689 million, reaffirming the strength of our diversified strategy and the high potential of

this segment. We added 5 branches during the quart.er taking our footprint to 97 branches across

the country thereby continuing to focus on disciplined execution and consistent sustainable

growth.”