Greater Noida: Kamdhenu Limited, India’s largest manufacturer and seller of branded TMT Bars, in the retail segment, has declared its Unaudited Financial Results for the quarter and nine months ended 31st December 2025.

Satish Kumar Agarwal, Chairman & Managing Director said: “Q3 and 9M FY26 continued to showcase Kamdhenu’s ability to deliver strong profitability despite witnessing volatility in TMT Bar ASPs. During the period, we recorded our highest-ever profit before tax and PBT margin, supported by the growth in our franchise volumes andrapidly rising royalty incomes. Royalty Income remains a highly capital-efficient and RoCE accretive business, allowing us to scale without incremental manufacturing investments.

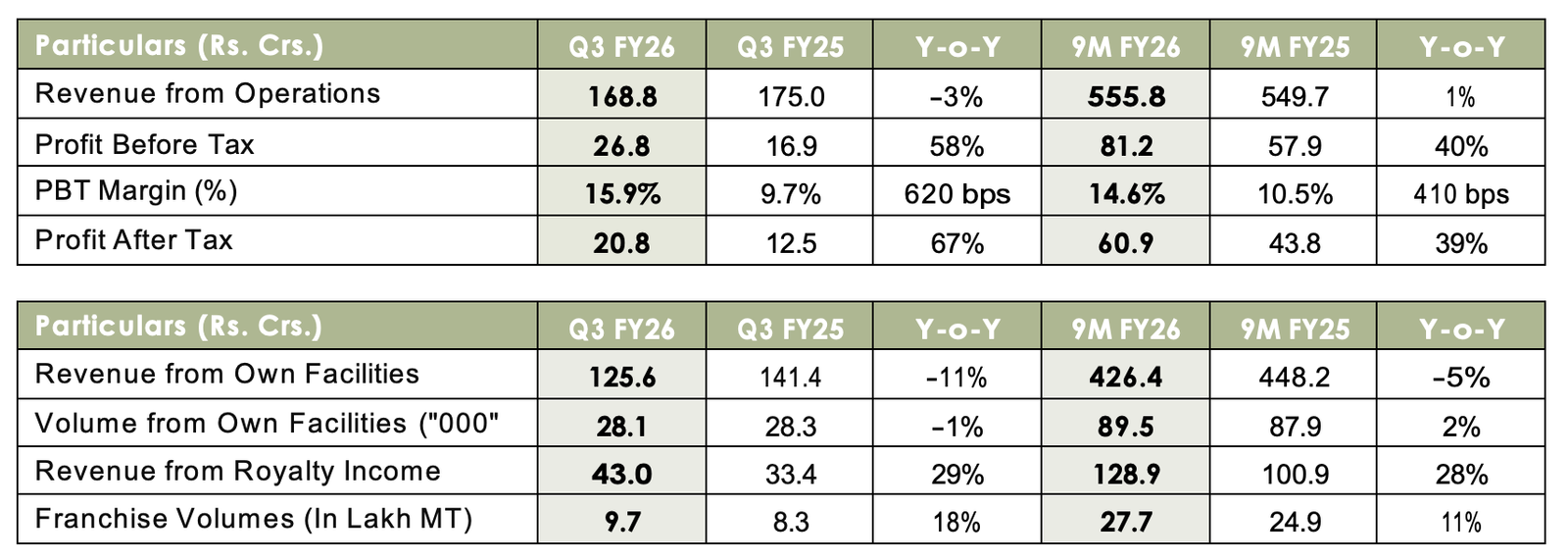

During Q3FY26, volumes from franchisees rose 18% YoY to 9.7 lakh MT from 8.3 lakh MT in Q3FY25. Royalty income achieved a record high during Q3 FY26 growing by 29% year-on-year to Rs. 43 crore. This reflects deeper brand penetration, improved partner throughput,and the increasing preference for Kamdhenu products across markets.

Overall, revenue from operations for Q3 FY26 stood at ₹169 crore, down 3% year-on-year, largely led by a decline in ASPs. The decline in realizations was primarily on account of metal price fluctuations across the industry. In addition, volumes from our own facilities were impacted during the quarter due to the implementation of GRAP Stage III and Stage IV measures in the NCR region.

However, profit before tax increased sharply by 58% to Rs. 27 crore. Our PBT margin expanded significantly by 620 basis points to 15.9% from 9.7% in the previous year. Profit after tax rose by 67% to Rs. 21 crore.

Given that our own manufacturing facilities are operating at near peak utilization, our strategic priority remains expanding through the asset-light franchise route. We are evaluating further investments in selective franchise partners to increase capacities where demand visibility is strong and where it strengthens our regional presence.

Supported by the expected revival in government and private capex and continued policy thrust on infrastructure, we remain confident of maintaining strong demand momentum in the fast-growing TMT bar segment and delivering consistent, profitable growth going forward.”