Mumbai: IndiGrid, India’s first and largest publicly listed power sector infrastructure investment trust (InvIT), announced its financial results on Thursday for the quarter and nine months ended December 31, 2025, along with key business updates.

Financial Update:

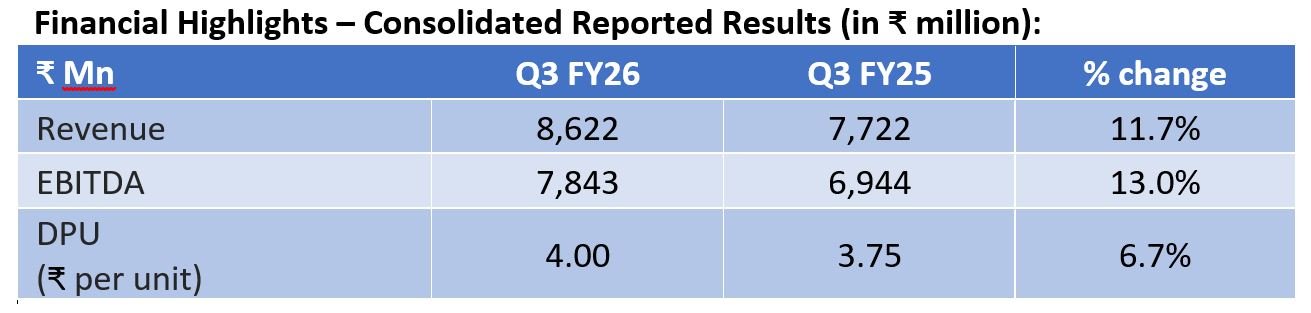

Revenue for the quarter stood at ₹8,622 million, representing a 11.7% year-on-year increase, driven primarily by the inclusion of newer projects in the portfolio. This growth translated into EBITDA of ₹7,843 million, up 13% year-on-year.

Net Distributable Cash Flow (NDCF) for the quarter was ₹3,283 million, reflecting a year-on-year dip of 1.4%, on account of higher working capital investment across the under-construction portfolio.

As of December 31, 2025, IndiGrid had Assets Under Management (AUM) of ₹328 billion, with a Net Debt to AUM ratio of 61.0%. Following the institutional placement, the leverage stood at ~56.5%.

The collections profile across both segments remained healthy, with collections of 90% and 38 receivable days for transmission assets, and 98% and 32 receivable days for solar assets.

Portfolio Update:

During the quarter, IndiGrid signed definitive agreements to acquire Gadag Transmission Limited, an ISTS project, with ~187 circuit kms and 1,000 MVA transformation capacity, located in Karnataka, from ReNew Power, for an enterprise value of ~₹372 crore. Subject to regulatory and contractual approvals, the acquisition is expected to be consummated by the end of the ongoing fiscal year.

IndiGrid also signed definitive agreements with EnerGrid to acquire two of its currently under-construction assets, one year post their respective commercial operations date (COD). These include a 125 MW / 500 MWh standalone Battery Energy Storage System (BESS) project in Uttar Pradesh, contracted by NTPC Vidyut Vyapar Nigam Limited (NVVN), for an enterprise value not exceeding ~₹957 crore, and a ~180 ckms and 4,500 MVA ISTS project in Madhya Pradesh, for an enterprise value not exceeding ₹1,577 crore.

With these agreements, the combined under-construction portfolio capex across IndiGrid and EnerGrid stands at ~₹7,500 crore.

Equity Fund Raise Update:

During the quarter, IndiGrid successfully raised ₹1,500 crore through an Institutional Placement, which was oversubscribed by ~2x. The issue saw strong participation from a diversified base of existing and new domestic and global long-only institutional investors. Proceeds from the equity raise will be utilised to support acquisitions, fund growth opportunities, and maintain a prudent capital structure.

DPU Update:

The Board of the Investment Manager approved a Distribution Per Unit (DPU) of ₹4.00 for Q3 FY26, representing a 6.7% increase over the same period last year and in line with full-year guidance of ₹16.00 per unit.

The record date for the distribution is February 17, 2026, and the distribution shall be paid as ₹2.9465 per unit as interest, ₹0.0074 per unit as dividend, ₹1.0143 per unit as capital repayment, and ₹0.0318 per unit as other income, in accordance with Section 115UA of the Income Tax Act.

Harsh Shah, Managing Director of IndiGrid, said, “This quarter reflects disciplined execution and continued momentum across our growth initiatives. We have raised over ₹1,900 crore of capital which paves a clear runway to scale our Assets Under Management up to ₹45,000 crore next few years.

During the quarter, we signed definitive agreements for three additional assets – one with ReNew and two with EnerGrid. Together with our announced acquisitions and under-construction pipeline, this provides visibility of over ₹8,000 crore of assets expected to be added to our operational portfolio over the next 24-30 months.

As India accelerates its energy transition, IndiGrid remains well positioned as a leading institutional platform in transmission and next-generation infrastructure, including Battery Energy Storage Systems, with a continued focus on disciplined capital allocation and predictable long-term returns.”