Puen: Bharat Forge Limited (BFL), announced its financial results on Thursday for the quarter ended December 31, 2025, reporting strong sequential growth in the quarter.

The quarterly performance continued to be impacted by the de-stocking in the North American CV market. Standalone Revenues was up 7.0% sequentially to Rs 2,084 crores and EBITDA at Rs 569 Crore was up 4.6% QoQ translating in an EBITDA margin of 27.3%. The performance was aided by the strong growth in the Domestic automotive business and execution of defence orderbook.

Export revenues witnessed a 3% sequential decline with auto sector down 13% and industrials showing a 11% increase. In Q3, the company secured new orders worth Rs 2,388 Crores including Rs 1,878 crores in Defence. As of Dec 31st 2025, the defence order book stood at Rs 11,130 crores. Bharat Forge signed the CQB Carbine contract with the Ministry of Defence for supply of more than 250,000 units to the Indian armed forces. This order unlocks significant growth opportunities for our Small Arms vertical within the Defence business. In the quarter gone by, JS Autocast (JSA) recorded revenue of Rs 203 Crore and EBITDA of Rs 32 Crore (15.7% EBITDA margin) representing a 22% and 39% YoY jump respectively.

K-Drive mobility, a supplier of axle assembly across segments witnessed a muted topline but a sharp jump in their profitability with EBITDA margins moving up from 3.1% in Q2 FY26 to 5.1% in this quarter. The company expects the margin profile to continue to improve over a 3-year time frame. The US & European operations reported modest operating profits despite seasonal weakness in the PV market. Review of the European steel manufacturing footprint is on track, and concrete measures are expected to be in place by the end of this fiscal.

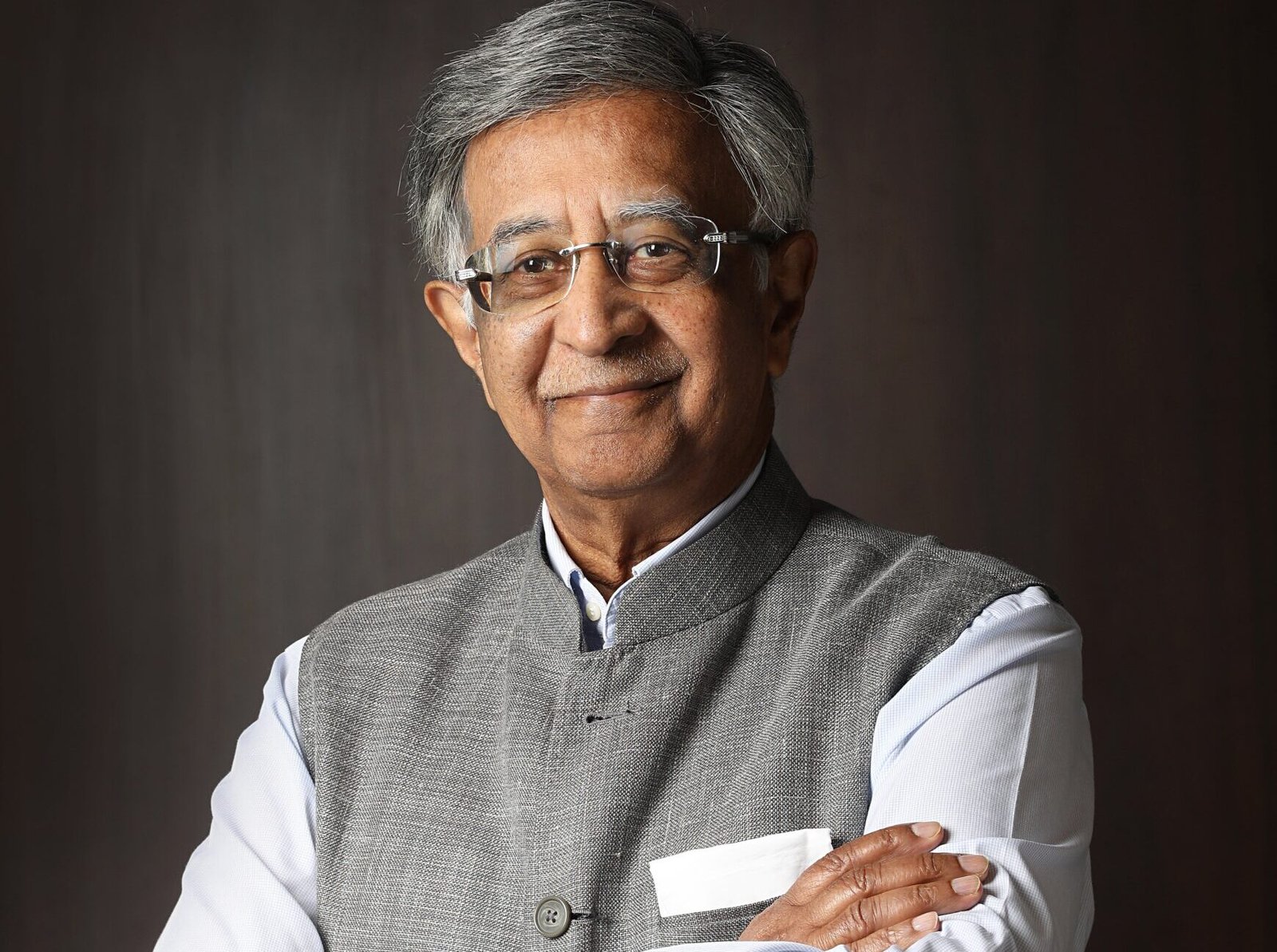

Baba Kalyani, Chairman & Managing Director shared, “Looking ahead into Q4 FY26 and FY27, it is fair to say that the worst is behind us and things are starting to look up. With both domestic and exports markets looking strong across sectors, and the commencement of ATAGS execution in H2 FY27, we expect high double digit top line growth and commensurate impact on profitability.”

Financial Highlights (Standalone)

- Revenue: ₹20,837 million (↑7.0% QoQ)

- EBITDA: ₹5,694 million (↑4.6% QoQ)

- EBITDA Margin: 27.3% (down 70 bps QoQ due to product mix & tariff costs)

- PBT (before exceptional items): ₹4,433 million (↑2.7% QoQ)

- PAT: ₹2,881 million

9M FY26 Performance:

- Revenue: ₹61,353 million

- EBITDA: ₹17,018 million

- PAT: ₹9,366 million