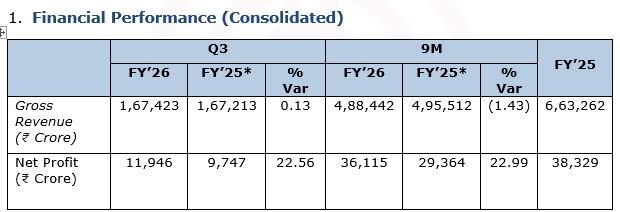

New Delhi: ONGC Board approved the results for Third Quarter (Q3) of FY 2025-26 In its 405th meeting held on 12th February 2026.

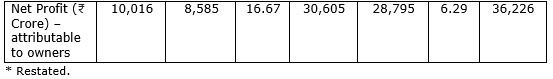

Details are as under:

During 9M FY’26, revenue from new well gas stood at ₹ 5,028 crore, delivering an additional ₹944 crore revenue compared to the APM gas price. New Well Gas now contributes more than 18% of total Gas sales revenue from ONGC portfolio.

3. Dividends

The Board has approved 2nd interim dividend of 125% i.e. ₹ 6.25 on each equity share of ₹5. The total payout on this account will be ₹ 7,863 crore. The Record date for distribution of dividend has been fixed for 18th February 2026 which has been intimated to the stock exchanges. This is in addition to 1st interim dividend of ₹ 6.00 per share (120%) declared earlier in Nov,2025.

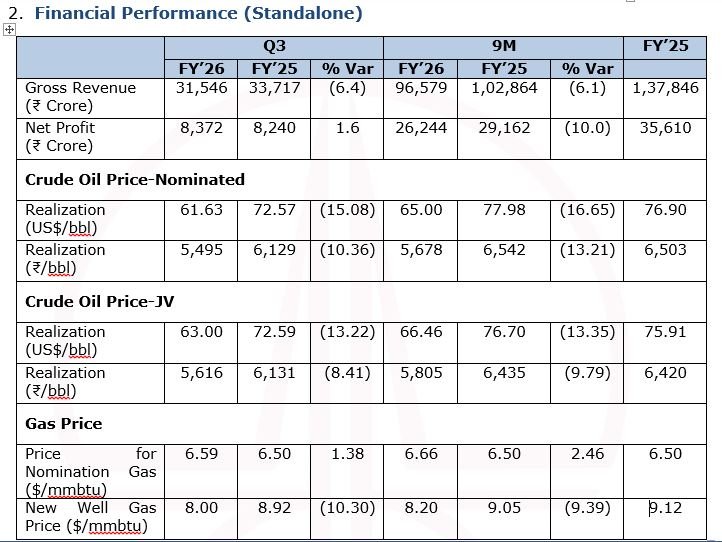

4. Production Performance

ONGC registered an upward growth of 0.35% in Crude Oil production during 9M FY’26 while Natural Gas production remains constant during the same period. The detailed production performance of ONGC is as under:

5. Exploration Performance

- A total of 735.82 LKM 2D and 4484.59 SKM of 3D seismic data was acquired up to Q3 FY’26.

- ONGC monetized 2 hydrocarbon discoveries during Q3 of FY’26, namely, Anor in NELP-VII block CB-ONN-2005/10 in Gujarat and Gojalia-14 in Gojalia PML in Tripura.

- Under Government of India’s sponsored initiative, ONGC is undertaking the drilling of the first stratigraphic well AND-P-1 in ultra-deepwater region of Andaman Basin. The well has been spudded on 27th January-2026.

- At the India Energy Week (IEW) 2026 in Goa, the Federation of Indian Petroleum Industry (FIPI) recognized ONGC as Exploration Company of the Year for excellence in efficient, safe, and sustainable exploration.