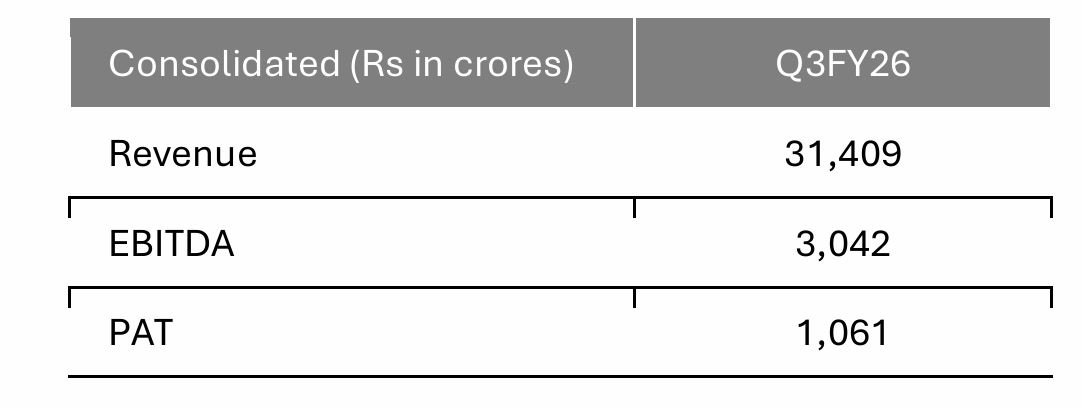

Greater Noida: Samvardhana Motherson International Limited (SAMIL) announced its financial results for the third quarter of fiscal year 2025-26 on Tuesday, which ended on 31st December 2025.

Vivek Chaand Sehgal, Chairman, Motherson, said, “This quarter is a significant step towards reaffirming Motherson’s position as a global design, engineering, manufacturing, assembly and logistics specialist. Customer trust, combined with our diverse capabilities, traction across automotive and non-automotive businesses, and the dedication of our global teams, has resulted in our highest-ever quarterly revenues. Our strategic investments and capacity expansions demonstrate our commitment to future growth while maintaining a comfortable 1.1x leverage ratio, highlighting our operational excellence. We are confident that with the support of our customers and dedication of our teams, we will continue to deliver long-term value to our stakeholders.”

Key Highlights

1) Net Leverage Ratio at 1.1x

Maintained leverage despite continued investments for growth and inflated working capital –concerted efforts are being made for deleveraging

2) 02 new Greenfields announced

New Greenfields in Emerging Markets: Morocco (Wiring Harness) and Pune (Vision Systems)

3) Capex during the quarter of INR 1,594 Crores (52% of EBITDA)

Primarily allocated for upcoming Greenfields and maintenance

4) To support customers with enhanced wiring harness solutions from additional global locations

Wiring Harness business of Nexans AutoElectric will provide a scalable platform for PVs and CVs globally.

5) Recently announced M&As likely to close in H1FY27

6) Organic growth to accelerate with a sharp ramp-up of consumer electronics and aerospace businesses

7) Multiple partnerships announced across businesses to aid future growth