Bhilwara: Sunrakshakk Industries India Limited engaged in the business of FMCG and FMCG intermediate chemicals, announced its Un-Audited Financial Results for Quarter and Nine Months Ended December 31st, 2025.

Key Financial Highlights – Q3 FY26 (Consolidated)

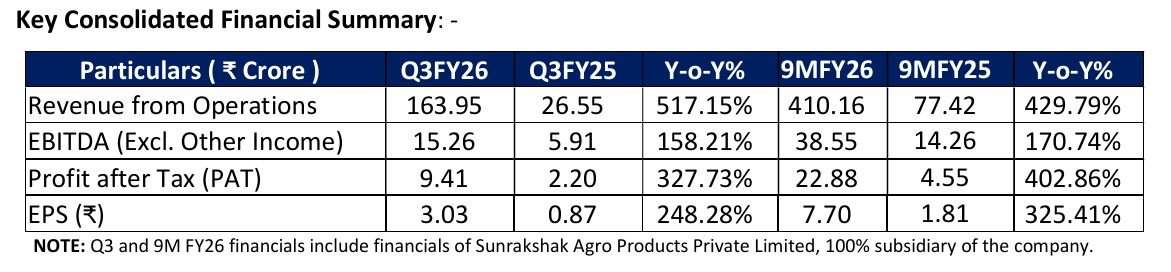

- Revenue Growth: Operations generated ₹163.95 crore, a staggering 517.15% YoY increase from ₹26.55 crore. This surge was primarily fueled by strong momentum in the FMCG and FMCG Intermediates verticals, alongside the strategic entry into the Edibles market.

- Operational EBITDA: EBITDA (excluding other income) climbed to ₹15.26 crore, up 158.21% from ₹5.91 crore in Q3 FY25. This expansion was supported by increased top-line scale and improved efficiencies from recent capacity additions.

- Net Profitability: Profit After Tax (PAT) witnessed a significant jump of 327.73% YoY, reaching ₹9.41 crore compared to ₹2.20 crore in the corresponding quarter last year.

- Shareholder Returns: Earnings Per Share (EPS) accelerated to ₹3.03, representing a 248.28% increase over the ₹0.87 reported in Q3 FY25.

Business Performance – Q3 FY26

- FMCG-Led Growth Momentum: Q3 FY26 witnessed strong scaling of the FMCG and FMCG Intermediates vertical, now the primary growth engine of the Company. Growth was driven by robust demand across detergents, personal care, and home-care categories, along with the successful ramp-up of the Edibles segment (Savories & Spices), supported by expanding distribution and multi-plant infrastructure.

- Strengthened Manufacturing & Regional Reach: The operationalization of the Guwahati facility significantly enhanced manufacturing capacity, improving serviceability in high-frequency consumption markets, particularly in the North-East. The Textiles division continued to provide stable support through consistent institutional and B2B demand.

Key Development:

- The Edibles segment achieved full operational scale during the quarter, with the upgraded Bhilwara units driving strong volumes in savories and spices, emerging as a meaningful contributor to revenue growth.

- The Guwahati FMCG facility commenced operations with installed capacities of 2,160 MT per month for Soap Noodles and 1,000 MT per month for Cosmetics, strengthening the Company’s integrated FMCG manufacturing footprint.

Saurabh Chhabra, Promoter & Director of Sunrakshakk Industries India Ltd, said: “Q3 FY26 reflects continued momentum in Sunrakshakk’s evolution into a diversified, growth-led FMCG company. The quarter witnessed strong

operational and financial performance, driven by the successful scaling of our FMCG and FMCG Intermediates

platform.

In Q3 FY26, Consolidated revenue increased by 517.15% YoY to ₹163.95 crore, supported by healthy demand across personal care and home-care categories and the first full-quarter contribution from our Edibles portfolio.

Profitability strengthened significantly, with PAT rising 327.73% YoY to ₹9.41 crore, reflecting operating leverage and improved capacity utilization.

For the nine months ended December 2025, the Company reported strong YoY growth, with consolidated revenue increasing by 429.79% to ₹410.16 crore and PAT rising by 471.08% to ₹22.88 crore, driven by expanding FMCG and Edibles operations, improving capacity utilization, and operational efficiencies.

The commissioning of our Guwahati facility in January 2026 has enhanced our manufacturing capabilities in soap noodles and cosmetics, strengthening our presence in high-growth regions. Meanwhile, our Bhilwara facilities continue to support the scale-up of the Edibles segment, reinforcing our multi-category FMCG footprint.

With a diversified portfolio, expanding distribution, and majority revenues from FMCG and FMCG Intermediates,

we remain focused on sustaining growth momentum and achieving ~₹1,000 crore in revenues by FY28. We view this as the first key milestone in our FMCG journey, and internally we have laid out encouraging long-term plans that position us for continued scale and value creation beyond this target”