Mumbai: A meeting of the Board of Directors of Tata Capital Limited (TCL) was held on Monday to consider and approve the unaudited consolidated financial results for the quarter ended December 31, 2025.

Rajiv Sabharwal, Managing Director & CEO, Tata Capital said, “We witnessed sustained business momentum in Q3FY26, with broad-based growth across products. Excluding Motor Finance, AUM grew 26% year-on-year to ₹ 2,34,114 crore, and comparable PAT(1) increased by 39% year-on-year to ₹ 1,285 crore for Q3FY26. Credit quality continued to remain robust, with early leading indicators reflecting stable portfolio performance across segments. Unsecured retail disbursements, which were moderated earlier as a prudent risk measure, have seen a gradual uptick, with slippages coming down. Our distribution network and strategic focus on digital and GenAI capabilities, continue to drive operating efficiencies.”

On Consolidated business including Motor Finance, he added “In Q3FY26, our AUM grew 7% quarter-on-quarter and PAT(1) rose 18% to ₹1,290 crore. Our Motor Finance segment achieved PAT(1) breakeven this quarter, and we remain focused on executing our strategic priorities.”

From a macro perspective he stated “India’s growth outlook remains robust, underpinned by resilient domestic demand, favorable demographics, and strong macroeconomic fundamentals.

Recent policy initiatives – such as GST rationalization, tax relief measures, repo rate cuts, and accommodative liquidity policies – are expected to further stimulate consumption and economic activity. We are well positioned to leverage these tailwinds, contribute to India’s long-term growth, and deliver sustainable value for all stakeholders.”

Representation of financial information:

➢ Tata Motors Finance Limited (Motor Finance) acquisition completed on May 8, 2025.

➢ For better understanding, we have presented figures both excluding and including Motor Finance business.

➢ While figures excluding Motor Finance can be compared on YoY and QoQ bases, figures including Motor Finance are best viewed on a QoQ basis.

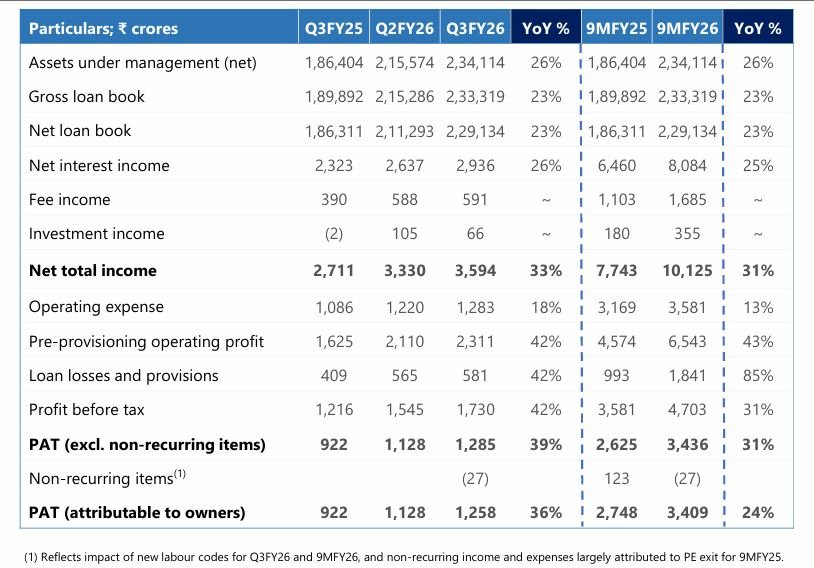

CONSOLIDATED PERFORMANCE HIGHLIGHTS – Q3FY26 Excluding Motor Finance:

➢Assets under management grew by 26% YoY to ₹ 2,34,114 crore as on December 31, 2025, from

₹ 1,86,404 crore as on December 31, 2024.

➢Net total income grew by 33% YoY to ₹ 3,594 crore in Q3FY26 from ₹ 2,711 crore in Q3FY25.

➢Annualized operating expense on average net loan book improved to 2.3% in Q3FY26 from 2.4%

in Q3FY25.

➢Cost to income ratio stood at 35.7% in Q3FY26 vs. 40.1% in Q3FY25.

➢Annualized credit cost was 1.0% in Q3FY26 vs. 1.1% in Q2FY26.

➢PAT (excluding non-recurring items) grew by 39% YoY to ₹ 1,285 crore in Q3FY26 from ₹ 922 crore in Q3FY25. Including such items, PAT grew by 36% YoY.

➢Annualized ROA at 2.3% in Q3FY26 vs. 2.0% in Q3FY25.

➢Annualized ROE at 14.3% in Q3FY26 vs. 14.1% in Q3FY25.

➢Gross stage 3 stood at 1.6% as of December 31, 2025.

➢Net stage 3 stood at 0.6% as of December 31, 2025.

➢Provision coverage ratio stood at 64.5% as of December 31, 2025.

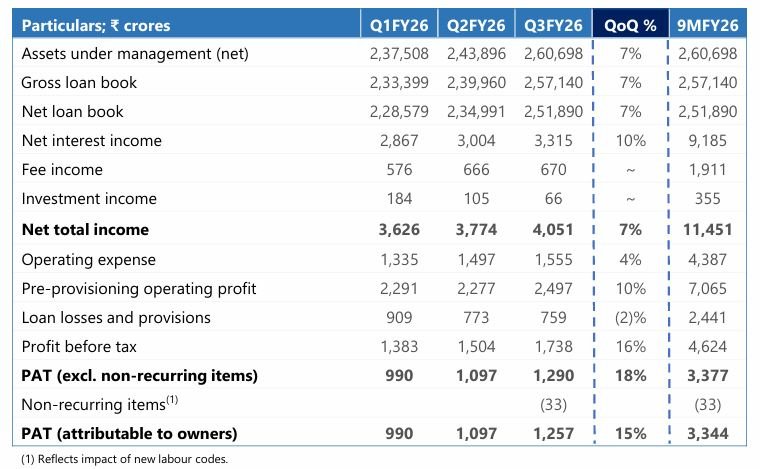

CONSOLIDATED PERFORMANCE HIGHLIGHTS – Q3FY26 Including Motor Finance:

➢ Retail + SME constitutes ~87% of Net AUM.

➢ Retail unsecured forms 10.4% of Net AUM | Disbursement in retail unsecured business has picked up.

➢ Pan India network of 1,505 branches across 27 states and union territories.

➢ Focused on improving business metrices in Motor Finance (~10% of Net AUM) before accelerating growth. Excluding labour code impact, Motor Finance business achieved PAT breakeven in Q3FY26.

➢ AUM grew by 7% QoQ to ₹ 2,60,698 crore as on December 31, 2025, from ₹ 2,43,896 crore as on September 30, 2025.

➢ Net total income grew by 7% QoQ to ₹ 4,051 crore in Q3FY26 from ₹ 3,774 crore in Q2FY26.

➢ Annualized operating expense on average net loan book of 2.5% in Q3FY26 vs. 2.6% in Q2FY26.

➢ Cost to income ratio stood at 38.4% in Q3FY26 vs. 39.7% in Q2FY26.

➢ Annualized credit cost of 1.2% in Q3FY26 vs. 1.3% in Q2FY26.

➢ PAT (excluding non-recurring items) grew by 18% QoQ to ₹ 1,290 crore in Q3FY26 from ₹ 1,097 crore in Q2FY26. Including such items, PAT grew by 15% QoQ.

➢ Annualized ROA at 2.1% in Q3FY26 vs. 1.9% in Q2FY26.

➢ Annualized ROE at 13.1% in Q3FY26 vs. 12.9% in Q2FY26.

➢ Gross stage 3 stood at 2.2% | Net stage 3 stood at 1.0% | Provision coverage ratio stood at 53.6% as of December 31, 2025.

➢ Total equity as of Dec-25 at ₹ 43,142 crore.

➢ Capital risk adequacy ratio stood at 20.3% as of December 31, 2025.

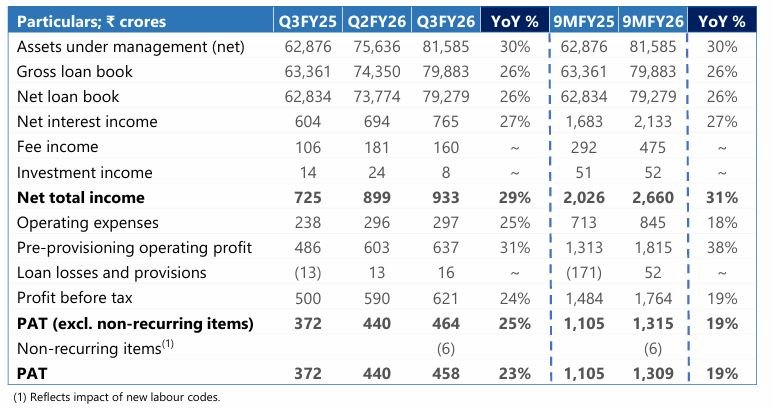

Material Subsidiary – Tata Capital Housing Finance Limited (TCHFL) Q3FY26 Performance

➢ 100% wholly owned housing finance company

➢ Assets under management grew by 30% YoY to ₹ 81,585 crore as of December 31, 2025 from

₹ 62,876 crore as of December 31, 2024.

➢ Net total income increased by 29% YoY in Q3FY26 to ₹ 933 crore from ₹ 725 crore in Q3FY25.

➢ Cost to income ratio was 31.8% for Q3FY26 vs. 32.9% in Q3FY25.

➢ Credit cost for Q3FY26 remained low at ₹ 16 crore (annualized 0.1% of average net loan book).

➢ Profit before tax increased by 24% YoY in Q3FY26 to ₹ 621 crore from ₹ 500 crore in Q3FY25.

➢ PAT (excluding non-recurring items) increased by 25% YoY in Q3FY26 to ₹ 464 crore from ₹ 372 crore in Q3FY25. Including such items, PAT grew by 23% YoY.

➢ Annualized ROA stable at 2.4% in Q3FY26 vs. 2.4% in Q2FY26.

➢ Annualized ROE at 18.6% in Q3FY26 vs. 18.5% in Q2FY26.

➢ Gross stage 3 stood at 0.8% | Net stage 3 stood at 0.4% | Provision coverage ratio stood at 54.2% as of December 31, 2025.

➢ Capital adequacy ratio as of December 31, 2025 was 16.9%.