Mumbai: IndoStar Capital Finance, a middle-layered non-banking finance company (NBFC) registered with the Reserve Bank of India, announced its financial results for the quarter and nine months ended December 31, 2025, earlier on Monday.

With the sale of its Housing Finance subsidiary, IndoStar now operates as a standalone NBFC with a clear focus on

two segments: Vehicle Finance (VF) and Micro Loans Against Property (M-LAP).

Financial performance

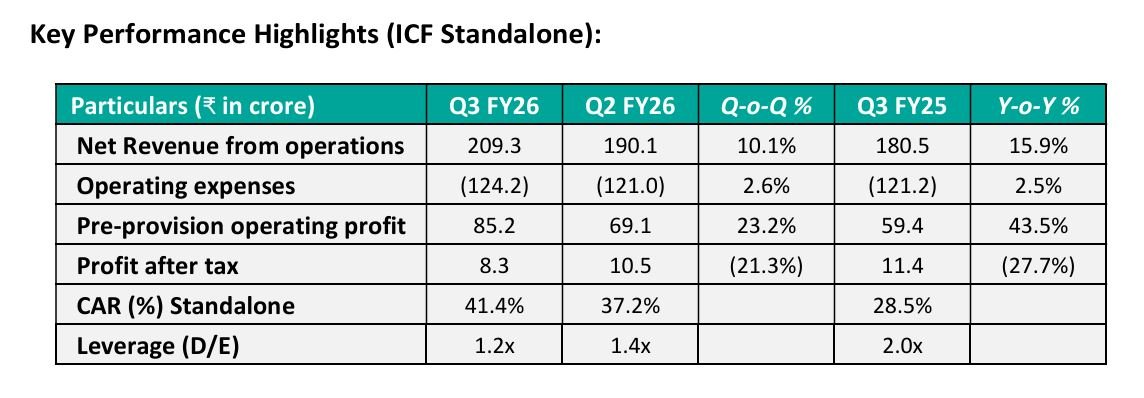

Disbursements for the quarter stood at INR 1,117 crore, representing 20% growth over Q2FY’26. As of December

31, 2025, AUM stood at INR 7,692 crore up 2% vis-à-vis Q2FY’26. Net revenue from operations grew 10% QoQ and

16% YoY, as a result of improved yield, which is up 70 bps YoY, and a reduction in cost of funds. Pre-provision operating profit (PPOP) at INR 85.2 crore grew 23% QoQ and 44% YoY, as a result of topline growth and cost improvements. At a standalone level, the Company delivered PAT of INR 8.3 crore. This includes one-time impact

of INR 4.8 crore increased employee benefit expenses on account of regulatory changes in the Wage Code.

Over the last few quarters, the company has been able to successively reduce its weighted cost of funds on a per

annum per month (p.a.p.m) basis to 10.09% in Q3 FY26, a 67-bps improvement compared to 10.76% in Q3 FY25.

The Company’s Gross Stage 3 stands at 4.06% in Q3FY26 and Net Stage 3 is at 1.75%.

Progress on strategic initiatives:

IndoStar continued to make progress on its key strategic priorities:

- Strengthening the Team:

o Mr. Amandeep Singh Sandhu joined IndoStar as Chief Operating Officer – Vehicle Finance. Mr. Sandhu

has 27 years of experience in the lending sector, including over 12 years at Cholamandalam

o Mr. Shivam Choudhary joined IndoStar as Chief Technology Officer. Mr. Choudhary has 20 years of experience in driving technology and tech transformation, including 11 years at PNB Housing Finance. - Infusing technology across the loan lifecycle:

o Automated credit approval via scorecards is now live for Cars and Small CV segments

o The company has rolled-out enhanced digital capabilities with an E-application with E-agreement and

E-NACH features, improving the speed of customer onboarding - Driving growth and profitability:

o IndoStar continued to grow its loan book across VF and Micro-LAP, with significant disbursement growth

at 20% QoQ; 21% in VF and 10% in M-LAP

o Sharp improvement in PPOP driven by improvement in yields, cost of funds, and cost optimizations - Cost optimization:

o Management continues to drive the ‘Lean, Efficient, Agile and Profitable’ (LEAP) initiative which has

resulted in significant cost savings over the past few quarters.

Conversion of Warrants

During the quarter, the Company allotted 1,08,69,565 equity shares to Florintree Tecserv LLP (“Florintree”) and

1,39,49,323 equity shares to BCP V Multiple Holdings Pte Ltd (“BCP V”) pursuant to the conversion of warrants and

receipt of the balance consideration from Florintree and BCP V.

As on December 31, 2025, BCP V and Florintree now holds 55.98% and 6.73% of equity share capital, respectively.