New Delhi: Paisalo Digital, a digitally enabled NBFC with over three decades of operating experience in lending to underserved, financially excluded, and emerging MSME/ SME segments, announced its financial results on Monday for the quarter ended December 31, 2025.

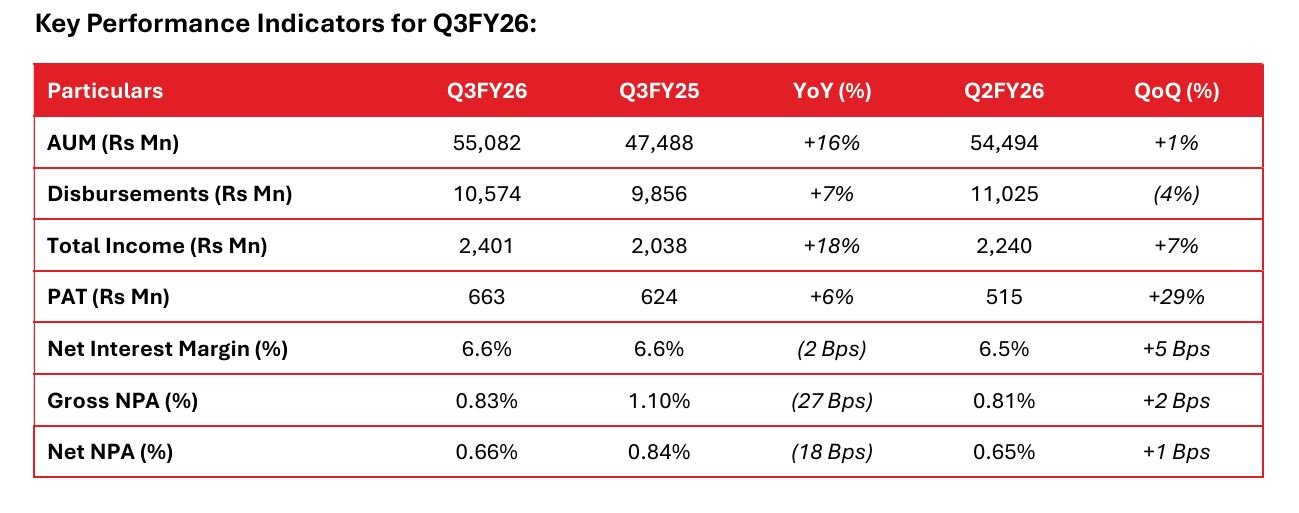

Key Highlights for Q3FY26 –

Assets Under Management (AUM) and Disbursement:

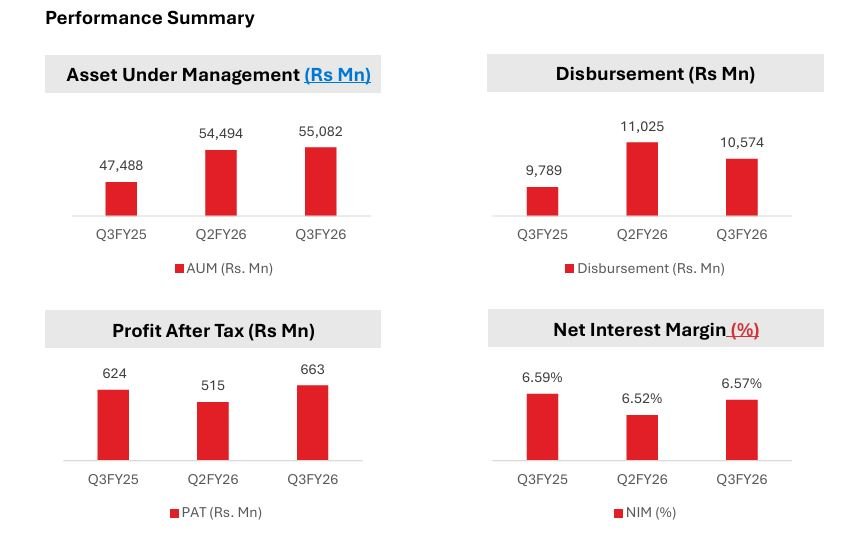

- AUM increased 16% YoY at Rs 55,082 Mn

- Disbursements rose 7% YoY, at Rs 10,574 Mn, reflecting sustained demand for credit

Distribution:

- Broadened reach with addition of 492 new touch points during the quarter – taking overall touchpoints base to 4,872 across 22 states

- Customer franchise expanded to a record ~14 Mn, with ~1.6 Mn customers added during the quarter, highlighting strong market penetration

Asset Quality:

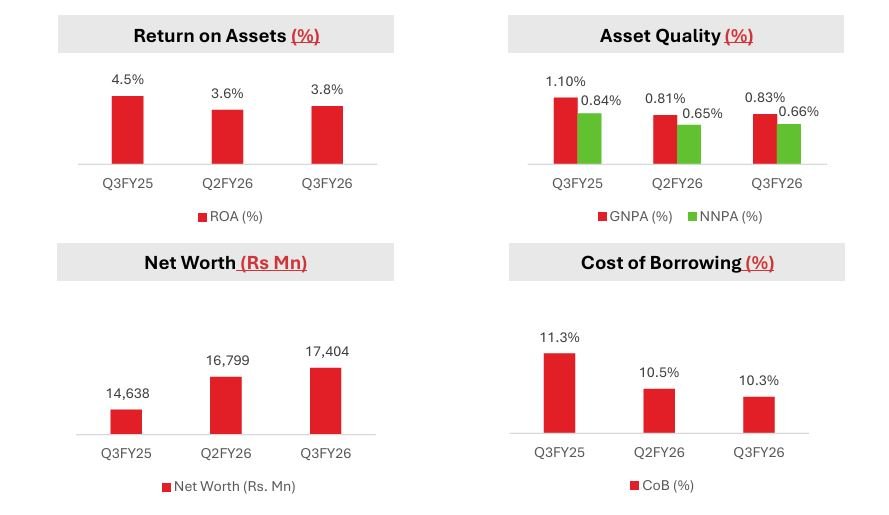

- GNPA and NNPA stood at 0.83% and 0.66% respectively

- Collection efficiency for the quarter stood at 98.8%

Borrowings:

- Total borrowings stood at Rs 38,579 Mn as of December’25

- Cost of borrowing improved significantly to 10.3%, down 92 bps from 11.3% in Q3 FY25, reflecting effective refinancing and a stronger credit profile

Profitability:

- Total income increased by 18% YoY from Rs 2,038 Mn to Rs 2,401 Mn

- Net Interest Income increased by 19% YoY from Rs 1,217 Mn to Rs 1,453 Mn

- Highest ever quarterly PAT of Rs 663 Mn, marking a 6% YoY increase

- NIM remained steady at 6.6% in Q3FY26

- ROA is at 3.8%; ROE at 12.6%

Capital Adequacy:

- Capital Adequacy Ratio remained robust at 38.3%; Tier 1 capital stood at a healthy 30.7%, underscoring the company’s solid financial foundation

- Net Worth grew by 18% YoY to Rs 17,404 Mn

Santanu Agarwal, Deputy Managing Director of Paisalo Digital Ltd, said: “Progress on India–US trade engagement, along with favorable macro policies have strengthened India’s economic outlook. The Union Budget 2026 further reinforced policy support for MSMEs through enhanced credit guarantees, improved access to growth capital, and stronger receivables-financing mechanisms, creating a favorable environment for sustained MSME growth and formal credit expansion.

Q3 FY26 marked another quarter of disciplined, sustainable growth for Paisalo. We expanded AUM by 16% YoY to Rs 55,082 Mn and delivered our highest-ever quarterly PAT of Rs 663 Mn, underscoring the strength of our operating model and stable asset quality. Our customer franchise reached ~14 million, with about 1.6 million additions this quarter. We also raised Rs 1,885 Mn at an 8.5% cost of funds, optimizing our liability profile to support capital efficient growth across MSME and income-generation lending.

Paisalo has embarked on a transformational journey to become an AI-first franchise, embedding AI across its lending, risk, and operations stack. By integrating advanced data ecosystems, automated workflows, and intelligent customer journeys, Paisalo is building a future-ready platform to drive sustainable, tech-led growth.”