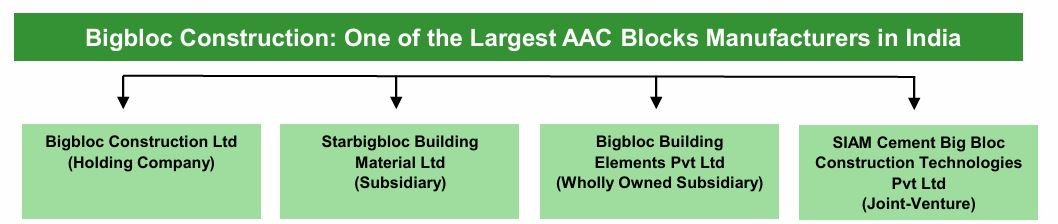

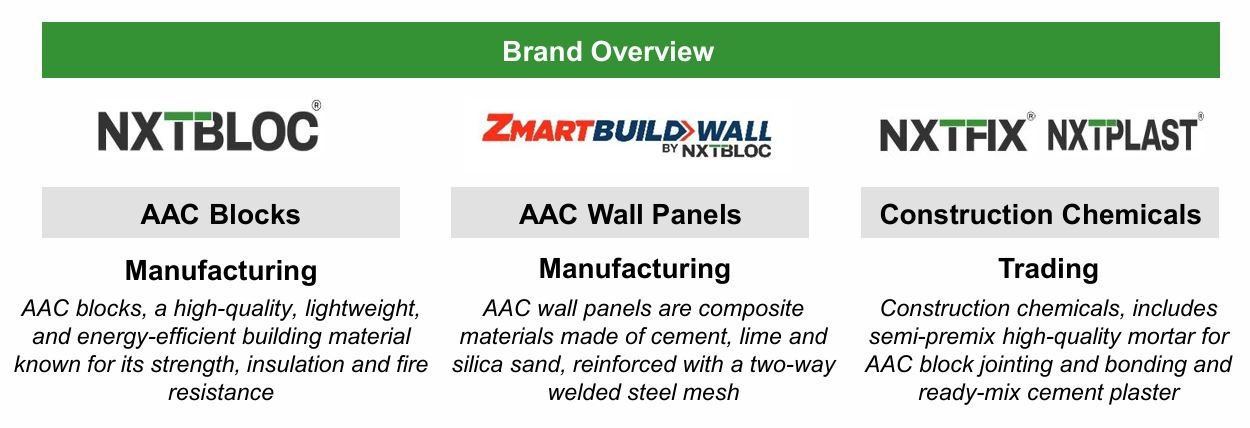

Surat: Bigbloc Construction Limited (“Bigbloc” or the “Company”) (BSE: 540061 | NSE: BIGBLOC), one of the largest manufacturers of Aerated Autoclaved Concrete (AAC) Blocks and Panels in India, has announced its unaudited financial results for the quarter ended 31st December 2025.

Narayan Saboo, Chairman and Non-Executive said: “In the third quarter of FY2026, Bigbloc Construction achieved its highest ever quarterly sales both in terms of volume and value. The quarter saw improved momentum in construction activity across key markets, supported by favorable weather conditions and improving demand environment in the building materials sector.

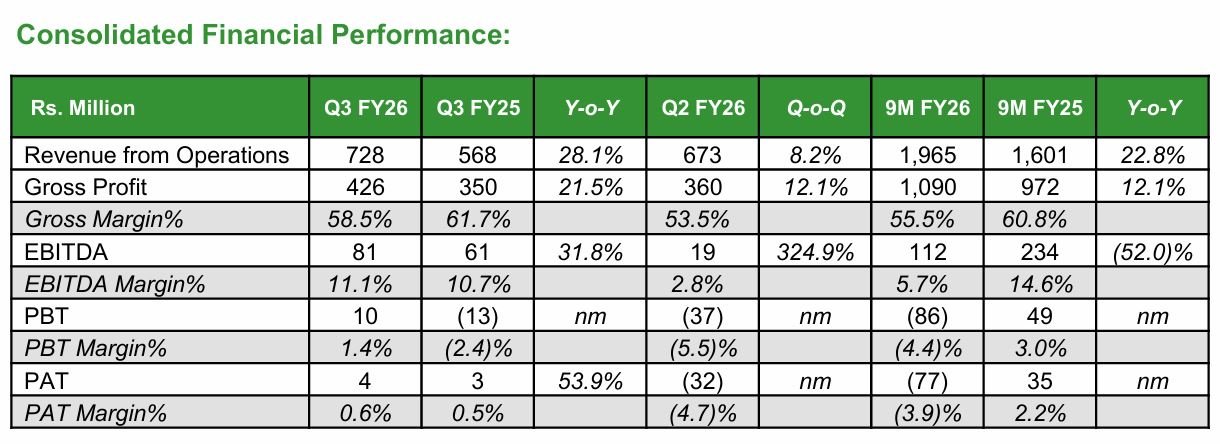

Revenue from Operations for Q3 FY2026 reached Rs. 728 million, reflecting an increase of 28.1% YoY and 8.2% QoQ. This growth was primarily driven by a 38.0% YoY increase in sales volumes,

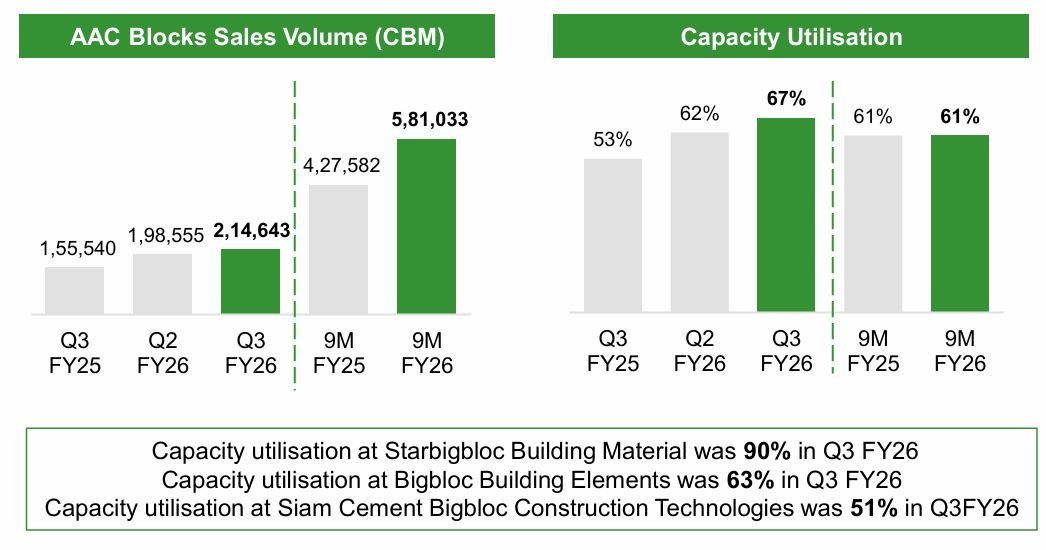

which reached 2,14,643 CBM. The increase in volumes was a result of better demand conditions, as well as higher capacity utilization.

In terms of profitability, Q3 FY2026 saw a substantial improvement in EBITDA, which was Rs. 81

million, an increase of 31.8% YoY. The EBITDA margin expanded to 11.1% from 2.8% Q2 FY2026.

The margin expansion was driven by higher capacity utilisation, improved price realisation and better operating leverage as fixed costs were spread over larger volumes. The Company also returned to profitability during the quarter, recording a PAT of Rs. 4 million, whereas PAT attributable to company’s owner was Rs. 18 million in Q3 FY2026.

Capacity utilisation improved to 67% in Q3 FY2026 compared to 62% in the previous quarter reflecting the strong pickup in order inflows and execution across facilities. The AAC wall panel business continued its upward trajectory, with capacity utilisation reaching 51% in Q3 FY2026, up from 43% in Q2 FY2026. The wall panel business is seeing enquiries from infrastructure and industrial projects and the Company expects order inflows in the coming periods.

For the nine months period, consolidated Revenue from Operations was Rs. 1,965 million, up 22.8% YoY and EBITDA was Rs. 112 million with a margin of 5.7%.

On the operational front, the Company received a major Purchase Order from Larsen & Toubro for

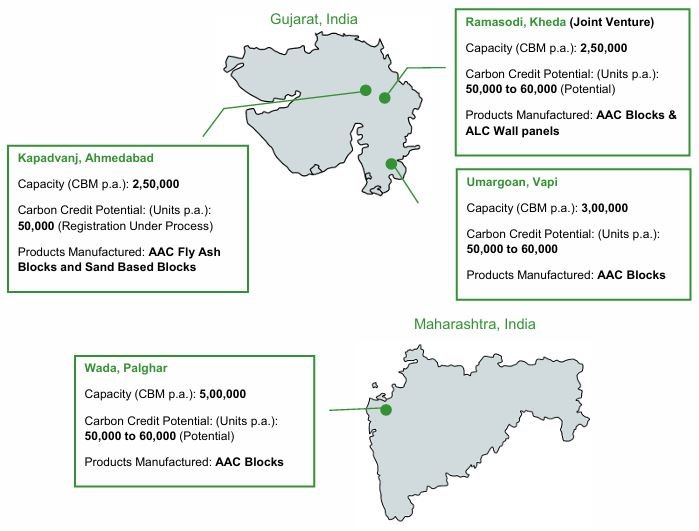

AAC Blocks, which reflects the growing acceptance of Bigbloc’s products among leading engineering and construction firms. Additionally, trial runs for the construction chemicals facility at Umargaon have commenced and commercial production is expected to begin soon.

On the sustainability front, the contribution of renewable energy to total power consumption has

increased to 36% in Q3 FY2026 from 26% in Q1 FY2026. This improvement reflects the Company’s

continued focus on reducing its carbon footprint and aligning operations with long-term environmental goals.

The construction sector is experiencing a positive phase driven by sustained government spending

on infrastructure and affordable housing, along with revival in private real estate development.

India’s building materials industry continues to benefit from the structural shift towards sustainable construction practices, creating favorable tailwinds for AAC products.

Looking ahead, the Company remains focused on further improving capacity utilisation levels across all facilities and scaling up the AAC wall panel operations to capture the growing opportunity in this segment. With construction activity expected to remain favorable in the coming months, Bigbloc is well positioned to deliver continued improvement in operational and financial performance in the quarters ahead.”