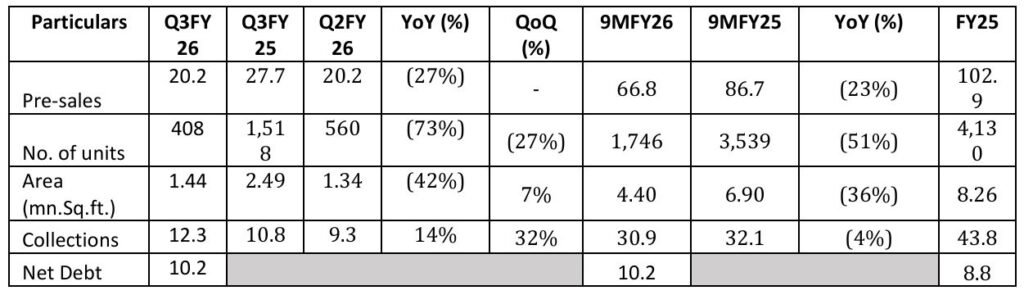

New Delhi: Signature Global (BSE: 543990 | NSE: SIGNATURE), one of the leading real estate development companies in India with a well-established brand in Delhi- NCR, on Sunday reported a healthy set of pre-sales number and strong collections. The pre-sales during 9M FY26 stood at INR 66.8 billion, while collections during the same period were INR 30.9 billion.

During Q3FY26, the company’s pre-sales amounted to INR 20.2 billion, while collections rose to INR 12.3 billion. During 9MFY26, the average sales realization increased to INR 15,182 per sq. ft. from INR 12,457 per sq. ft. in FY25, driven by increased sales in premium markets and sales price increase across key regions.

The company’s net debt stood at INR 10.2 billion at the end of 9MFY26.

Below are the operational highlights for the quarter ended December 31, 2025:

Commenting on the company’s performance, Mr. Pradeep Kumar Aggarwal, Chairman and Whole Time Director, said, “We delivered a healthy performance during the first nine months of FY26, driven by sustained demand across our focused micro-markets. The launch of our wellness-centric premium project, Sarvam at DXP Estate on Dwarka Expressway, witnessed encouraging customer response, reflecting evolving buyer preferences. Strong collections, improving realizations and disciplined balance sheet management underline execution strength. Looking ahead, current momentum and planned launches keep us broadly aligned with our guidance and support our longer-term growth plans.