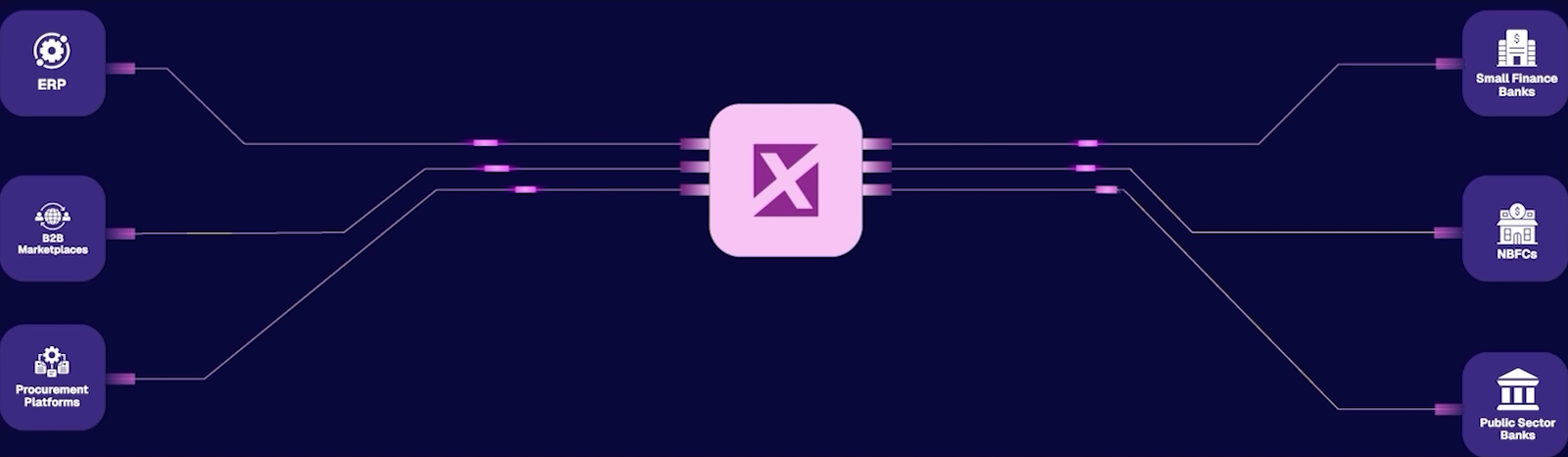

New Delhi: PSB Xchange, India’s multi-lender embedded supply chain finance ecosystem, has announced the successful onboarding of 20 strategic partners across six critical business and technology verticals. This milestone reinforces its role as a foundational digital infrastructure for delivering institutional finance at scale across India’s enterprise and MSME ecosystem.

The expanded onboarding marks a significant step in PSB Xchange’s journey from platform enablement to ecosystem orchestration. By embedding financing directly into procurement, distribution, treasury, trade, and SME operations, the platform is enabling credit to flow seamlessly within everyday business workflows — reducing friction, improving visibility, and strengthening lender confidence.

Six Verticals Driving Embedded Finance Expansion

- Supply Chain Finance (SCF) Fintechs: Platforms specializing in invoice-based financing and automated dealer, distributor, and vendor finance workflows.

Partners onboarded: Xtracap, Supermoney, Aton Capital, Deleverage, FinnUp, EFUNDZZ, Capwing Fintech, Finsso, Aurelix Venture Partners, Invoyz - B2B Marketplaces: Digitizing trade flows across industrial supply chains, enabling buyers and sellers to access financing at the point of transaction.

Partners onboarded: Metstak, Steeloncall, Metalbook - Procurement & Procure-to-Pay Platforms: Strengthening liquidity predictability by financing buyer-approved invoices within enterprise purchasing workflows.

Partners onboarded: Zaggle, Techpanion - Corporate Advisory Firms: Acting as intermediaries for structured financing solutions aligned with institutional lending standards.

Partners onboarded: PFSL, Ocean Bridge Advisors - Distribution Technology Platforms: Embedding financing into dealer and distributor networks to ensure seamless credit access.

Partners onboarded: Avysh, Succesship - Treasury Technology Platforms: Extending supply chain finance into treasury-led working capital optimization.

Partners onboarded: IBS Fintech

Leadership Perspective

Sorabh Dhawan, CEO of PSB Xchange, commented: “This milestone reflects the direction in which PSB Xchange is evolving – from enabling transactions to powering an integrated embedded finance ecosystem. By onboarding partners across six strategic verticals, we are ensuring that institutional credit can be accessed where commercial decisions are actually made. Our focus remains on building a common digital financing layer that scales responsibly while meeting the transparency, governance, and risk expectations of lenders.”

Looking Ahead

With these 20 new partnerships, PSB Xchange is now positioned to support businesses across multiple industries while offering lenders a standardized and interoperable route to deploy working capital solutions. The platform continues to evaluate a growing pipeline of prospective partners across additional platforms and use cases. By maintaining a structured and selective onboarding approach, PSB Xchange aims to expand responsibly — ensuring every new integration strengthens the ecosystem, enhances lender confidence, and deepens the reach of embedded finance across India’s digital trade infrastructure.